Section 75 of the Consumer Credit Act: Here’s Everything You Need to Know About Section 75 Claims

Payments industry regulations are labyrinthian. They’re hard to navigate, and subject to change at any time. Some pieces of legislation are more foundational than others, though. Like Section 75 of the Consumer Credit Act 1974, for example.

Section 75 played a significant role in shaping how eCommerce developed in Europe. The rule, less than 300 words in length, determines how billions of dollars get routed every year.

In this article, we’ll break down all the key points you need to know, including what Section 75 is, how it works, who it protects, who it holds liable, and what it does and doesn’t cover.

Recommended reading

- Chargeback Laws: What's the Legal Basis for Card Disputes?

- American Express Chargeback Time Limits: The 2025 Guide

- Chargeback Time Limits: the Merchant's Guide for 2025

- Chargeback Police Report | Can You Report Dispute Abuse?

- Is Chargeback Fraud Illegal? Here’s the Simple Truth.

- Here are Your 9 Basic Chargeback Rights as a Merchant

What is Section 75 of the Consumer Credit Act?

- Section 75

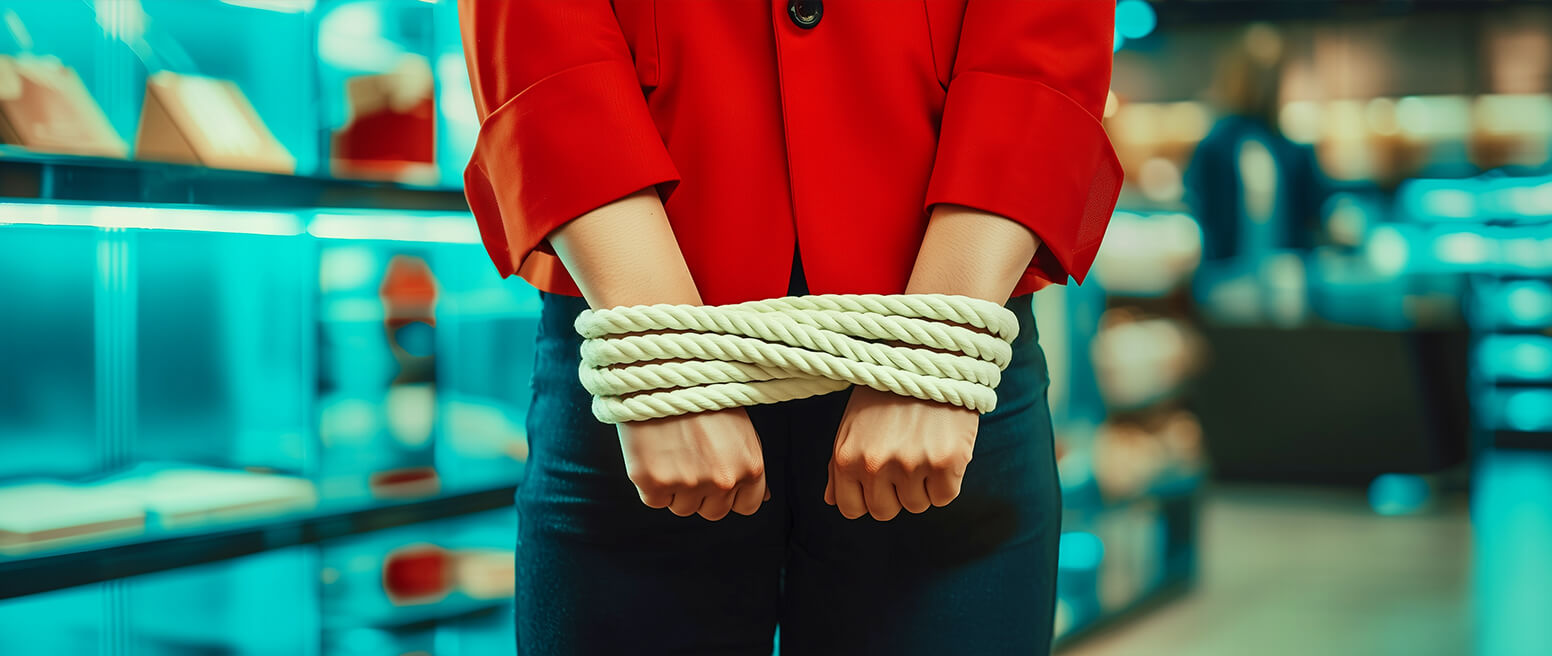

Section 75 of the Consumer Credit Act is a complex piece of legislation adopted in the UK. It places responsibility for credit card issuers to refund a cardholder and/or pay for consequential loss expenses incurred by the cardholder, where misrepresentation or breach of contract has occurred. Contingent liability may also apply.

[noun]/sek • SHən • se • vən • tē • fīv/

The key point of Section 75 of the Consumer Credit Act is that credit card issuers are “joint and severally liable” if a consumer has an issue with anything they purchased using their credit card. The Act is quite specific in that before the creditor (card issuer) can be held liable the debtor (the cardholder) must be able to establish a claim for misrepresentation or breach of contract against the supplier (merchant).

Section 75 gives credit cardholders the right to file a claim regarding a transaction of more than £100, but less than £30,000. Even if only a deposit was made via the credit card, the entire purchase price may also be covered.

Here's the full text of the legislation:

Section 75: Liability of creditor for breaches by the supplier.

(1) If the debtor under a debtor-creditor-supplier agreement falling within section 12(b) or (c) has, in relation to a transaction financed by the agreement, any claim against the supplier in respect of a misrepresentation or breach of contract, he shall have a like claim against the creditor, who, with the supplier, shall accordingly be jointly and severally liable to the debtor.

(2) Subject to any agreement between them, the creditor shall be entitled to be indemnified by the supplier for loss suffered by the creditor in satisfying his liability under subsection (1), including costs reasonably incurred by him in defending proceedings instituted by the debtor.

(3) Subsection (1) does not apply to a claim—

(a)under a non-commercial agreement,

(b)so far as the claim relates to any single item to which the supplier has attached a cash price not exceeding £100 or more than £30,000, or

(c)under a debtor-creditor-supplier agreement for running-account credit—

(i)which provides for the making of payments by the debtor in relation to specified periods which, in the case of an agreement which is not secured on land, do not exceed three months, and

(ii)which requires that the number of payments to be made by the debtor in repayments of the whole amount of the credit provided in each such period shall not exceed one.

(4) This section applies notwithstanding that the debtor, in entering into the transaction, exceeded the credit limit or otherwise contravened any term of the agreement.

(5) In an action brought against the creditor under subsection (1), he shall be entitled to have the supplier made a party to the proceedings in accordance with rules of court.

What is Covered Under Section 75?

All the legal jargon can be confusing. So, if you take away nothing from the last section, just know that cardholders are covered by Section 75 if misrepresentation or breach of contract has occurred. For instance, if:

- their purchase didn't arrive.

- the product or services were faulty or not in the condition described (this applies even if the description was verbal).

- the company that the product or service was purchased from is no longer in business and there is a subsequent dispute.

Cardholders can also claim associated consequential additional losses suffered because of the failure. Picture this: you’re on vacation, but the airline you booked your return flight with goes bust in the middle of your trip (it can happen). You could claim costs like additional nights spent in a hotel while waiting for a replacement flight.

In the UK, you can file a Section 75 claim if you’re dissatisfied with a purchase and:

- you used your credit card to make a deposit (even if it's just 1p) on an item for which the total price exceeds £100, but is less than £30,000.

- the item does not match its description.

- the item is defective.

- you did not receive the item.

- the retailer has gone into liquidation or insolvency.

- you did not receive the item.

- you incurred extra expenses due to a cancelled event (such as hotel or train tickets).

Section 75 covers face-to-face, online, mail order, and phone purchases. It covers domestic purchases, as well as purchases made with international sellers.

What is Not Covered Under Section 75?

Most credit card transactions fall within the scope of Section 75. But, there are some circumstances where the law doesn’t apply:

*Other conditions may apply to OTAs with a registered ATOL (Air Travel Organizer’s License).

How are Section 75 Claims Different From Chargebacks?

The biggest difference between Section 75 and chargebacks is the time limit.

The time limit for claiming a chargeback varies between 45 and 540 days after the purchase, with specific time limits dependent on the card network and the chargeback reason code. In contrast, a Section 75 claim can be made up to 6 years after the transaction in question.

The stated purpose of Section 75 is to ensure credit card issuers are jointly liable for any breach of contract or misrepresentation by a retailer or trader. In a lot of ways, it’s similar to US-based legislation, like the Fair Credit Billing Act. The key difference is how liability is apportioned.

Section 75 stipulates that credit issuers can be held jointly liable for a transaction dispute, rather than just the merchant retailer (as is the case in the US). The credit issuer enabled the transaction. So, the law holds them co-accountable for everything. If customers want their money back, they can go to the retailer and ask for a refund, or go directly to the creditor. It’s ultimately the cardholder’s choice who they pursue.

Taking that a step further, the creditor might also be responsible for additional costs, like statutory interest and any financial loss the cardholder has suffered as a direct result of the breach of contract or misrepresentation. Each case is assessed under its own merits. The creditor may decide to take action to recoup their losses from the merchant when appropriate.

How to File a Section 75 Claim

So, how do you actually go about filing a Section 75 claim?

We should preface this by recommending that you try to resolve the issue with the retailer first. Collaborating with the retailer is not required under Section 75, but you may be able to get your money back a lot faster if the retailer can simply provide a refund or remedy your dispute. If the retailer is unresponsive or uncooperative, though, you can skip to the next step, which is to contact the card issuer.

Be sure to have these documents on hand before calling:

- Proof of purchase

- Any terms and conditions governing the purchase

- Evidence that the goods or services were either not supplied, damaged, faulty, or not as described

- Evidence that you’ve already tried to recoup the loss from the retailer

- An explanation of what (if any) response you got from the merchant

- All documentation you have pertaining to the claim

- Full explanation as to why you believe a breach of contract or misrepresentation has occurred

When you contact the credit issuer, you should tell the customer service representative that you want to “make a claim under Section 75 of the Consumer Credit Act.”

Your credit issuer will investigate the claim, and may try to work with the retailer to resolve the issue. You can expect to receive a refund, including any additional costs, like consequential or contingent liability directly from the credit card provider, if the claim is proven.

Next Steps: Escalating to the Financial Ombudsman

There’s no time limit set for your credit card company to refund your money. But, if you’re unhappy with how your credit provider handles the situation, you can file a complaint with the Financial Ombudsman Service.

If you do this, remember that you’re making a complain about the financial institution, not the retailer. Basically, you’re telling the ombudsman that your creditor failed to live up to their obligations under Section 75.

You’ll need to have records of all calls and communication with the credit provider in question. Once you have the documentation, you can file a complaint using the Financial Ombudsman Service website.

The Ombudsman will look at what all the different parties have said, as well as transaction paperwork, photos, videos, etc. They may instruct the issuer to take one of the following actions:

- 1. Refund you, either in part or in full

- 2. Instruct the credit provider to pay for a repair, or for completion of work

- 3. Refund interest, charges, or repayments

- 4. Collect the goods, at no cost to you

- 6. Uphold the issuer’s decision

Additional Questions? Ask the Experts.

The Consumer Credit Act is a complicated piece of legislation, and Section 75 is just one small component of it. If you interpret any portion of the regulation wrong, it could can have serious consequences.

Have additional questions about Section 75 of the Consumer Credit Act? Click below and get connected with our team of global dispute regulation experts.

FAQs

What is the Consumer Credit Act in the UK?

The Consumer Credit Act 1974 in the UK is legislation designed to regulate the consumer credit industry, ensuring fair and transparent practices between lenders and borrowers. It provides crucial protections for consumers, including the right to challenge credit agreements and seek redress in cases of unfair treatment.

What is the Section 75 regulation?

Section 75 of the Consumer Credit Act 1974 provides consumers with legal protection for purchases made with credit, giving them the right to claim against their credit provider if goods or services costing over £100 and under £30,000 are faulty, not delivered, misrepresented, or a breach of contract has occurred. This regulation holds the credit issuer jointly and severally liable, ensuring consumers can seek financial redress without needing to resolve the issue solely with the seller.

Can section 75 be reversed?

No. A Section 75 claim cannot be reversed once it has been successfully invoked and a claim has been settled. However, consumers can withdraw their claim at any stage before resolution if they choose to do so.

Does section 75 cover business transactions?

Section 75 of the Consumer Credit Act does not generally cover business transactions, as it is designed to protect individual consumers.

Who is protected by the Consumer Credit Act?

The Consumer Credit Act primarily protects individual consumers who enter into credit agreements with lenders. It ensures they have legal safeguards against unfair lending practices and provides avenues for redress in cases of disputes or misrepresentation.