Top 12 PayPal Scams to Watch Out For in 2024

In February 2024, PayPal filed their Form 10-K with the U.S. Securities and Exchange Commission (SEC).

In the first section of this report, the company revealed that 391 million consumer and 35 million merchant accounts were registered with the platform. Together, PayPal’s 426 million users completed 25 billion transactions, totaling $1.53 trillion in value in 2023.

I bring this up to illustrate the scale of the company’s checkout and payment processing platform. And, given the massive footprint that PayPal has in the payments space, it’s inevitable that scammers are going to try to leverage the platform to their advantage.

Estimates suggest that PayPal has an overall fraud rate of 0.17% of revenue. This causes the company and its users to suffer approximately $1 billion in losses per year; a figure that may increase as fraudsters explore even more sophisticated tactics.

Recommended reading

- eBay Resolution Center: The Guide for Buyers & Sellers

- PayPal Account Limitations? Here are 5 Ways to Respond.

- PayPal Refund Scams: How They Work & How to Stop Them

- PayPal Chargeback Time Limits: 2025 Rules & Timelines

- PayPal Dispute Fees: How PayPal Chargeback Fees Work

- PayPal Purchase Protection: What is it & How Does it Work?

What is a PayPal Scam?

It’s kind of a vague term. So, for the sake of clarity, when we’re referring to a “PayPal scam,” we’re talking about any fraudulent, dishonest, or illegal activity perpetrated on the PayPal platform.

Perpetrators of many PayPal scams are usually trying to trick users into sending money or personal information. The recipient is typically an associate of the perpetrator, or the perpetrator themselves.

All PayPal scams contain some element of deception. The scammer poses as someone legitimate, like a business or peer the user is familiar with. The scammer then tries to convince their target to initiate or complete a transaction. The user will think that they have sent money to a trusted recipient. Unfortunately, they will have inadvertently diverted their funds to the perpetrator instead.

Top 12 PayPal Scams of 2024

No two PayPal scams are exactly the same. But, many fraudulent activities involve similar tricks. Below, we’ll outline 12 of the most common tactics that these PayPal scammers tend to use:

PayPal Scam #1 | Advance Fee Scams

Ever received an unsolicited email from a person you don’t know? Maybe they reach out to you about legal fees or other documents for which they have no actual evidence. The person asks you to wire a small amount to an unknown party up front. In return, they promise to reward you with a large sum of cash.

Of course, the funds you advanced to the other party vanish, and the reward money never shows up. Not only that, but any information you send to the other party can be used in additional fraud schemes like account takeover.

This is a modern version of a classic wire fraud scam, and it’s one of the oldest tricks in the book. However, victims still fall for it.

Pro Tip:

Never send money to people you don’t know! If an unsolicited offer seems too good to be true, then it probably is. You should ignore anyone asking for this kind of advance PayPal payment.

PayPal Scam #2 | Overpayment Scams

This one is tricky. In this scenario, a fraudster will make a purchase via a user’s account, overpaying for the cost of the goods. The individual then contacts the seller to request the difference.

The buyer will probably claim that the extra money was for shipping costs, or was a bonus for excellent customer service. If they ask you to wire the funds directly to the “shipping company,” though, this is part of the scam.

Of course, once the legitimate account holder realizes what happened, they will dispute the charge. By that point, you’ve already shipped the goods. The buyer is gone, having nabbed free merchandise, and getting stolen cash through the user’s account as a bonus.

Pro Tip:

Whatever the reason they provide, legitimate customers do not make overpayments. The attempt, therefore, is probably the result of a stolen credit card or breached account. You should flag the transaction immediately.

PayPal Scam #3 |Shipping Scams

There are a couple of other ways a cybercriminal might try to defraud you with a shipping scam. These include:

- ‘Preferred’ Shipping: A fraudster attempts to get you to use their own shipping connection because of a ‘discount’ they might receive, or because the agency is one they ‘trust’ more.

- Rerouted Shipping: If you use the faux buyer’s shipping account, they can contact the company and relay orders to an outside address. They can then claim that they never received the item and request a refund. As if that weren’t bad enough, once the actual account holder realizes they’ve been a victim of fraud, they can file a chargeback.

Pro Tip:

Never use any shipping accounts or make arrangements outside your preferred methods. Only ship purchases to addresses listed in the transaction details and flag any attempts to change your shipping process for potential fraud.

PayPal Scam #4 |Fake Account Scams

Fraudsters are pretty crafty about setting up fake PayPal accounts. These fake accounts can look just like the real thing, with a detailed profile of a person or entity who doesn’t really exist (a practice called synthetic identity fraud).

The two most frequent account scams are false charities and fake online shops. In either case, scammers catch your attention with flashy advertisements and trick you into making a donation or purchases via PayPal. However, your money just ends up getting taken by an imposter.

Never send unsolicited money to someone you don’t know. Also, do your homework before donating to any charities or making purchases from shops you’ve never heard of before.

PayPal Scam #5 |Shipping Label Scams

Shipping label scams occur when a fraudster, posing as a legitimate buyer, makes a purchase, but requests that you use their own pre-paid shipping label to cover shipping costs. The explanation will likely be that it costs them less, or they receive a discount for having things shipped this way. If you consent, they will send the package to an untraceable location.

Remember, to be covered under PayPal's Seller Protection policy, you must ship to the address on the Transaction Details page. So, once the cardholder disputes the charge, you’ll be forced to accept responsibility.

Again, never use any shipping accounts or make arrangements outside your preferred methods. To take this a step further, never accept shipping labels from customers under any circumstances, and flag all transactions associated with these attempts.

PayPal Scam #6 |Partner Scams

In this PayPal scam, you’ll be contacted by someone who claims they’d like to partner up with you to sell products. If you agree, they may ask you to sell items on a platform they control. It’ll be pitched as an exciting opportunity to get in on the ground floor of an up-and-coming platform. One problem: you’ll never receive any money.

In this case, the platform owner can pose as multiple buyers and make fraudulent transactions. You’d then be liable for these purchases once the cardholders discovered what happened.

The link takes you to a dummy page which asks for your login credentials. Once entered, the fraudster will gain access to your account, as well as any banking or address information on file.

You need to do your due diligence about anyone you plan to do business with. Confirm vendors and suppliers are who they say they are, and make sure that they’re running a legitimate operation. You don’t want to pass up a great business opportunity, but you don’t want to be so eager that you play into fraudsters’ hands.

PayPal Scam #7 | Phishing Scams

We could create an entire list dedicated to different phishing scams. For now, though, we’ll focus on one of the most common.

The victim gets a email that appears to be an official PayPal notification or a clickable link asking for verification. Often, the aim is to convince you that PayPal has put a hold on your account, or even that funds have been removed from your account. In response, you must follow the link provided to fix the problem. This is a PayPal scam email, though.

The link takes you to a dummy page which asks for your login credentials. Once entered, the fraudster will gain access to your account, as well as any banking or address information on file.

Watch where you click! If you receive an email asking you to type in any login information, STOP and take a hard look at it before proceeding. If the email came from PayPal directly, odds are they will not ask you to supply them with credentials they already have. It’s also a good idea to right-click and copy link addresses, then paste them into your browser, rather than simply clicking to follow from an email. You could get redirected to a malicious site without even realizing it.

PayPal Scam #8 | Affiliate Scams

A lot of businesses use affiliate marketing to bolster sales and increase revenue. Be aware that fraudsters are getting pretty good at gaming this system, though. As an advertiser, you might be charged for campaigns you never requested, or even get flooded with fake purchases from bad affiliates.

In this scam, you’d pay out commissions for unearned sales, and also lose production costs and incur chargeback fees.

You are not in control of affiliate accounts, but you can still pay for their mistakes. Ensure that your affiliates supply you with regular progress reports and never agree to pay for services not rendered.

PayPal Scam #9 | Friendly Fraud

This is not exclusive to PayPal. However, it is a common PayPal chargeback scam that you need to watch for. Friendly fraud, or chargeback abuse, is one of the fastest-growing threats facing eCommerce merchants.

Part of the problem is that the cardholder may not even realize they're doing anything wrong. Some buyers file chargebacks, believing they have a valid claim, without realizing what they're doing. In other cases, though, the buyer is deliberately abusing the chargeback process to get free goods (a practice commonly called cyber shoplifting).

Your options are limited in terms of friendly fraud prevention, as it's generally a post-transaction PayPal scam. However, you can try to recover your money by engaging in tactical representment.

PayPal Scam #10 | Rental Listing Scam

Fraudsters who concoct rental listing scams are usually trying to hijack a legitimate listing, or simply create a bogus one.

The scammer poses as a real estate agent. Victims are asked to send application fees or security deposits to the perpetrator’s PayPal account under the false promise that there will be a property to move into once the funds are received. However, the scammer is advertising a fake listing; there’s no rental property, and the scammer pockets the fees and deposits sent.

Never pay an application fee or a security deposit until you have verified the legitimacy of a listing by touring it in-person. While on your tour, make a note of the listing agent who is showing you the property. Write down their contact information, and get a business card if possible.

PayPal Scam #11 | Cryptocurrency Exchange Scam

In October 2020, PayPal rolled out the ability to buy, sell, or trade cryptocurrencies like Bitcoin and Etherum on their platform.

Some PayPal scammers are using the feature to scam unwitting users. For instance, they may offer to exchange dollars (or another national currency) for Bitcoin, or vice versa, at a “more favorable” exchange rate than the official market rate.

Unfortunately, no exchange occurs. The PayPal cryptocurrency scammer simply keeps the victim’s funds and provides nothing in return.

Only buy, sell, or trade cryptocurrency on PayPal through official channels. Decline all invitations to make off-market cryptocurrency trades on PayPal.

PayPal Scam #12 | Invoice Scam

Businesses send invoices to customers to request payment for goods sold or services rendered.

PayPal scammers posing as businesses or independent contractors may send unwarranted invoices to victims demanding payment for goods or services the victim may have never purchased.

On rare occasions, invoice scams are used to carry out phishing attacks. Here, the PayPal scammer may pose as a legitimate business that the victim had in fact purchased from. When the victim pays the invoice, however, the money is sent to the scammer, rather than the real business.

Never pay an invoice from a company you do not recognize. If an invoice appears to be from a legitimate company, verify that you have a contract in place, and confirm that the type and quantity of the purchase listed on the invoice is correct. Make sure that invoices received come from a verified PayPal or company email address.

PayPal Scams in Action: Real-World Examples

It may be difficult to picture how these PayPal scams really work without seeing how they actually play out. Below are a couple of examples of high-profile scams carried out using PayPal, to help you get a better understanding of the situation:

Example #1: Fake Cryptocurrency Invoice Overpayment Scam

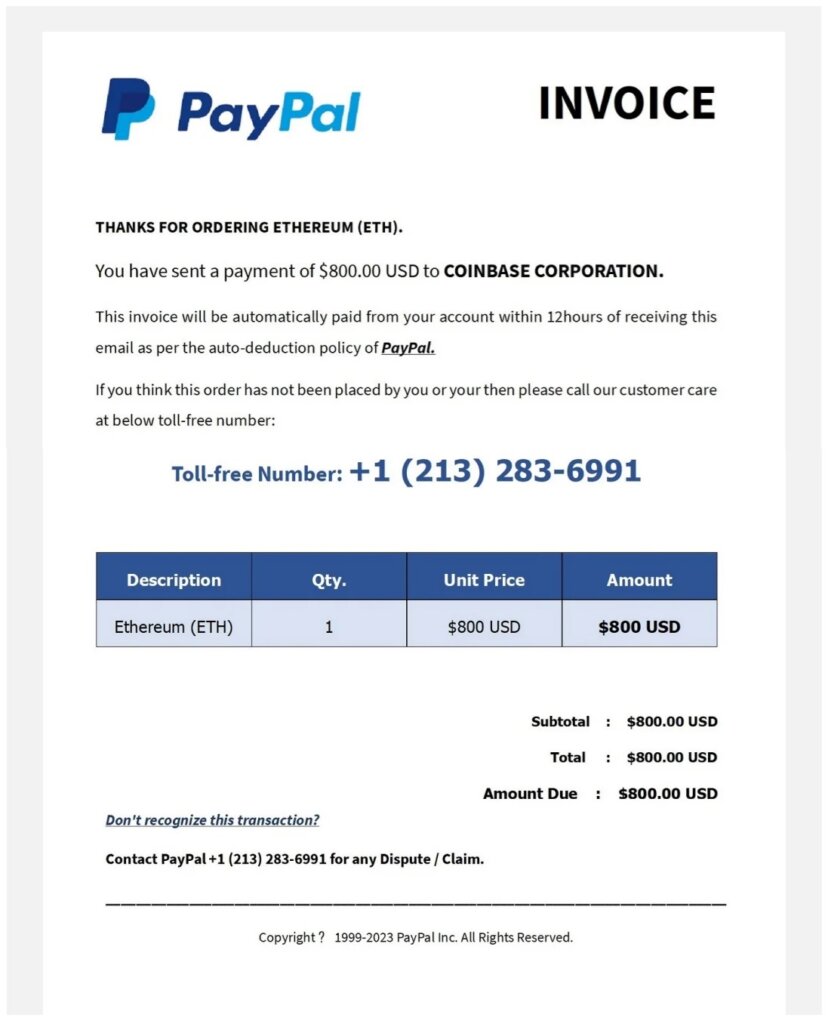

In early 2024, Reddit user u/LooksCrunchyGranola received a suspicious email from a scammer posing as a PayPal representative. Attached to the email was an invoice that showed the user had allegedly purchased $800 worth of Ethereum. Printed on the body of the invoice in large font is a generic (non toll-free) number.

This is a classic refund or overpayment scam. Rather than send a payable invoice, this emailed invoice is completely fake. No Etherum was purchased, and no money will be deducted from the victim’s account.

A key ingredient in this scam is the suspiciously large phone number in the body of the invoice. The perpetrator hopes that the victim will become alarmed by the invoice and call the number. The victim will then be transferred to a scammer, who will demand the victim provide payment details or personal information in order to “cancel” the purported “transaction.”

Example #2: Chargeback/Friendly Fraud Scam

Several years ago, Reddit user u/Collier1505 sold an iPad Pro for $750 on the subreddit r/HardwareSwap. The buyer transferred funds to the seller using PayPal. The seller shipped the item, and the buyer soon provided a signature to the courier to confirm that they had received the iPad as ordered.

One month later, the buyer filed a chargeback, and PayPal reversed the transaction. Despite evidence from the seller that the iPad had successfully shipped to the buyer and was sold as described, the dispute was resolved in the buyer’s favor. The seller is now left with a negative balance in their PayPal account.

This is an instance of chargeback misuse, or friendly fraud. This form of fraud occurs when a buyer purchases an item from a seller and files a chargeback with the issuer (in this case, PayPal) for illegitimate reasons. In u/Collier1505’s case, it turns out that the buyer had committed chargeback fraud against at least five other sellers on r/HardwareSwap.

Unfortunately, sellers have limited options if they fall victim to chargeback fraud. One way a merchant can fight a chargeback is through the chargeback representment process. But, this is a time-consuming and expensive route that, as demonstrated in u/Collier1505’s case, does not always resolve in the seller’s favor.

How to Recover Funds From a PayPal Scam

Falling victim to a PayPal scam can be a difficult and frightening experience. There is no guaranteed way to recover funds after you have lost them to a scam. However, you can take some steps to safeguard your personal and financial information and position yourself against future losses.

How Can Merchants Prevent PayPal Scams?

Overall, PayPal is a great option for P2P and eCommerce payments. That’s not to say PayPal is perfect, though.

Reporting PayPal scams when discovered can help prevent future attacks. However, any PayPal scams reported by sellers would be, necessarily, retroactive. So, is there anything sellers can do to actually prevent PayPal scams before they happen?

No payment processor or payment platform is immune to fraud. Therefore, our best advice for merchants looking to limit PayPal scams are as follows:

| Best Advice |

|

|

|

|

|

|

|

|

It's easier to face PayPal scams once you know what you’re up against. Learning what to watch out for is just as important as the methods you employ to fight back.

FAQs

Are there any PayPal scams going around?

Yes. PayPal scams, ranging from refund scams and phishing scams to invoice scams and cryptocurrency scams, are abundant. Scams on PayPal are estimated to cause the company and its users more than $1 billion in losses per year.

How do you know if someone is scamming you with PayPal?

Although there is no surefire way of distinguishing a well-disguised scam from a legitimate transaction, PayPal scams typically involve generic greetings like “Dear User,” and come from unknown email addresses or phone numbers. PayPal scammers may also use fake links, bogus websites, suspicious attachments, or social engineering tactics to compel you to give up your personal or financial information.

What are the red flags of PayPal scams?

Red flags of PayPal scams include payment requests via the “Friends and Family” payment option, unauthorized attempts to access your account or device, generic greetings, or high-pressure tactics.

Can someone access your bank account through PayPal?

Other users cannot access your bank account if you send payments through PayPal. However, if a scammer or hacker gains unauthorized access to your PayPal account directly, they may be able to gain access to the bank accounts you have connected to your PayPal account.

Can a scammer hack your PayPal?

Yes. Some scammers may use phishing techniques to try to steal your PayPal login credentials, passwords, and phone numbers. If a scammer successfully captures your personal information, they may be able to hack into your PayPal account.