Mastercard Reason Code 4808 Cardholder-Activated Terminal (CAT) 3 Device

Mastercard chargeback reason code 4808 is one of the numeric labels assigned by banks to each customer dispute, indicating the given reason for the claim. We say the given reason because it may or may not reflect the true reason.

Under certain circumstances, Mastercard may allow consumers to reverse a payment card transaction by filing a chargeback. Chargebacks were designed to be a “last-resort” for disagreements that cannot be resolved with the merchant. However, they’re more and more often used as a tool to commit fraud.

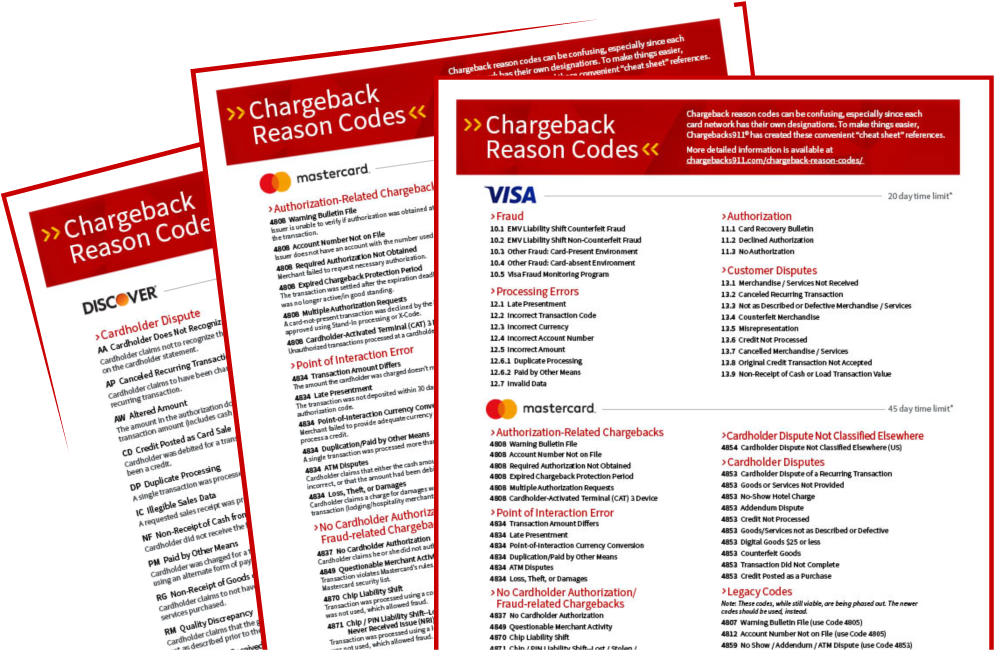

Reason code 4808 indicates the broad category “authorization-related chargebacks.” This generally means there’s some argument as to whether a transaction was authorized by the issuer at the time of sale. When necessary, an additional message will be provided along with the reason code to inform the merchant which particular type of chargeback applies to the claim. In claims featuring a 4808 reason code, one of the possible causes is “Cardholder-Activated Terminal (CAT) 3 Device.”

Should Merchants Worry About Reason Code 4808 Chargebacks?

Chargeback questions? We have answers. Click to learn more.

What Is a CAT 3 Device?

A cardholder-activated terminal, or CAT, refers to unattended terminals that can accept payment cards for a transaction. The most recognizable example would be pay-at-the-pump fuel stations. However, CATs are also commonly used for ticket stations, toll roads, parking garages, and more. Some restaurants utilize them to speed up the ordering and checkout processes, and they have other uses as well.

The terminals must be programmed to comply with specific regulations based on how they are being used. These types of terminals are divided into seven levels; CAT 3 is for “Limited Amount Terminals,” and they will be identified as such in any authorization messaging.

Specific business types that fall under the CAT 3 level include:

- MCC 4684: Bridges, Tolls

- MCC 7523 Parking, Garages

- MCC 7542: Car Wash

- MCC5499: Vending Machines

What Is a CAT 3 Device Chargeback?

Chargebacks with a CAT 3 device reason code come directly from the issuer, not the cardholder. They refer to instances in which a transaction is processed through a merchant’s cardholder-activated terminal, but either the card was not valid at the time, or the transaction amount was more than the acceptable limit.

Terminals with a level 3/Limited Amount designation are required to electronically cross-reference the account number of the transaction against the Electronic Warning Bulletin file (if it is enabled). If the number is listed in the Bulletin, the merchant must terminate the transaction and/or request a different method of payment.

If the transaction is processed with a bad account number, it will typically result in a CAT 3 device chargeback. The same is true if the transaction exceeds the acceptable limit, which can vary by region.

CAT 3 Device Chargebacks: Conditions and Prevention

As we alluded to earlier, a false reason code may be used by a customer to mask an attempt at fraud. In the case of CAT 3 transactions, however, the responsibility for any errors lies with the merchant.

The good news is that these types of chargebacks are 100% preventable. Obviously, if a business regularly receives chargebacks with a CAT 3 device reason code, there’s a problem that needs to be addressed by the merchant. But with care on the merchant’s part, the conditions that can trigger this chargeback situation should be entirely avoidable.

Preventative steps include:

- Ensuring that transactions are checked against the Electronic Warning Bulletin, if enabled.

- Always request authorization, even for automated transactions.

- Do not process CAT 3 transactions for more than the maximum amount.

If a chargeback is filed, however, the issuer is under a strict time limit. Disputes must be filed within 90 calendar days of the processing date.

Chargeback Prevention: A Wider View

While merchants can take many steps to help prevent legitimate claims, fraudulent chargebacks are another matter. Friendly fraud is post-transactional in nature, meaning there’s no sure way to identify it beforehand. Merchants can do everything “right,” yet still have a dispute filed against them.

It’s generally more efficient to take a proactive stance when it comes to chargeback management. However, a truly-effective strategy must encompass both preventing chargebacks and disputing cases of friendly fraud.

Chargebacks911® can help your business manage all aspects of chargeback reason codes, with proprietary technologies and experience-based expertise. Contact us today for a free ROI analysis to learn how much more you could save.