What is Payment Routing? How Can it Be Used to Reduce Chargebacks?

This article has been published in collaboration with our good friends over at Basis Theory, a provider focused on helping merchants with PCI compliance and creating more flexibility in their payment workflows.

There are a number of parties involved in a single card transaction. The transaction touches each hand in a specific order. But, the process of routing the payment data from one party to the next can vary quite a bit.

Some paths are much faster and more efficient than others. This is where payment routing becomes a key factor.

Recommended reading

- What is EMV Bypass Cloning? Are Chip Cards Still Secure?

- Dispute Apple Pay Transaction: How Does The Process Work?

- Terminal ID Number (TID): What is it? What Does it Do?

- What is EMV Technology? Definition, Uses, Examples, & More

- Visa Installments: How it Works, Benefits, & Implementation

- dCVV2: How do Cards With Dynamic CVV Codes Work?

What is Payment Routing?

- Payment Routing

Payment routing is the process of selecting the most optimal path for a payment transaction to travel through various financial entities. It ensures efficiency, speed, and cost-effectiveness by leveraging different networks and gateways.

[noun]/pā • mənt • rout • iNG/

Payment routing determines the path for a transaction after a customer initiates a payment. This is also known as intelligent payment routing, smart payment routing, or least-cost routing.

Regardless of its name, the end goal remains the same: find the optimal path for each transaction based on factors like location, amount, and payment method. Executing a payment routing strategy — and doing this well — ensures the merchant has the highest likelihood of closing the deal at the lowest possible processing cost.

How Does Payment Routing Work?

Routing can be achieved through a static process, where a fixed route is assigned for each transaction. Or, merchants can deploy dynamic routing, which selects the optimal processing route for each transaction.

A payment’s path or “route” is determined by predefined rules and available processors. Banks, payment gateways, processors, payment service providers (PSPs), card networks, and tokenization providers can all play a role in routing payments for a merchant.

Once a transaction is initiated, the routing decision is made based on the predefined rules or algorithms. This could include a cascading payment strategy, which retries failed transactions to alternative processors.

There are two fundamental types of payment routing: static or dynamic (i.e. “intelligent”) routing.

Static Routing

Static routing requires manually assigning a fixed route for every transaction. An example of static routing would be swapping different iframes to capture cardholder information based on the customer's location (as identified by IP address) so that the customer sees the preferred payment methods for their geography.

This predefined logic is done at the front end and is based on a single piece of data. For example, the location of the customer initiating the transaction could determine which iframe is presented and which PSP the payment is routed to. The iframe captures the cardholder information and tokenizes the data immediately, returning a token used to authorize the transaction with a PSP. This can be for point-of-sale purchases, subscription renewals, or from a mobile wallet like Google or Apple Pay.

Dynamic Routing

This is also known as back-end processor switching, or as “intelligent,” or “smart” routing. Dynamic payment routing uses algorithms to select the best route for each transaction based on real-time data.

Broadly speaking, dynamic routing uses multiple pieces of data. As more information is collected, the proper iframe is then presented. That decision is based on merchant category code (MCC), transaction size, location, or convenience.

Whether back-end or front-end switching, being powered by a programmable token vault can improve authorization rates and deliver a superior customer experience.

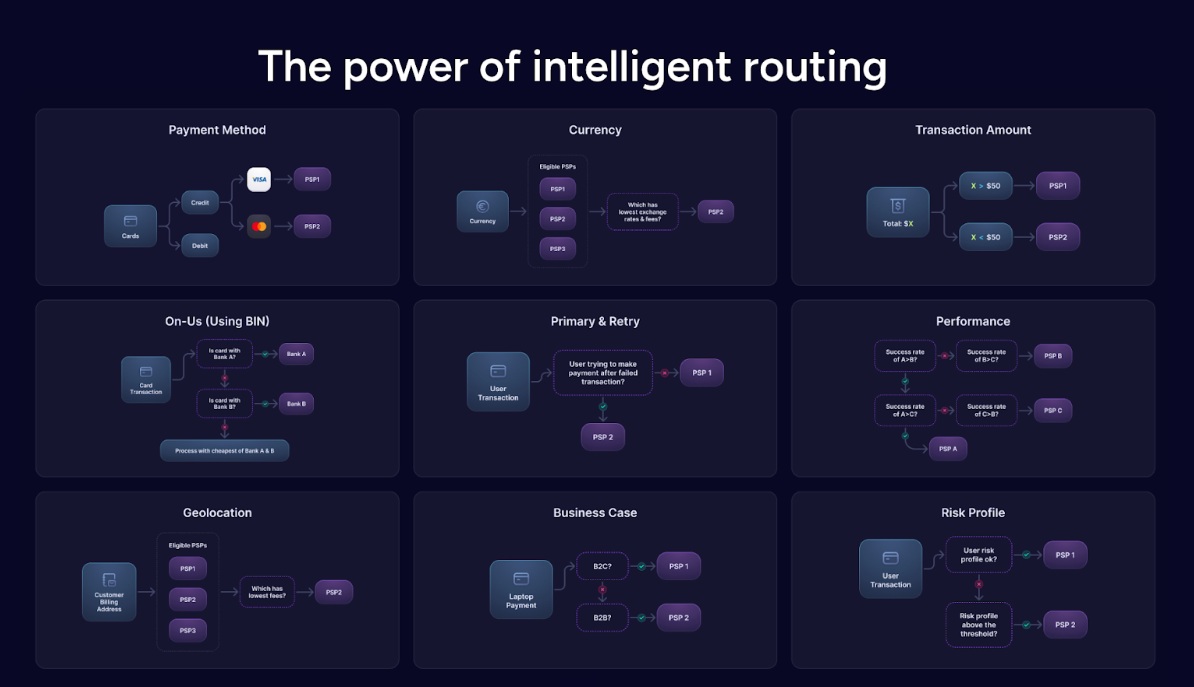

You can click on the graphic below to expand it out and examine intelligent routing as applied to a variety of transaction variables:

It might be worth noting that one of the challenges with static routing is the lack of a consistent user experience when you need to swap different PSP iframes. In contrast, dynamic routing with a universal third-party iframe gives you consistency across all geographies and all mediums (web, mobile, app, etc.)

Additionally, robust fraud detection algorithms and compliance with industry standards like PCI DSS further enhance security. However, the level of security largely depends on the merchant's choice of payment service providers (PSPs) and their adherence to best practices in securing the payment ecosystem. When set up correctly, dynamic routing can deliver both efficiency and a high level of protection for all parties involved.

Why Should a Merchant Deploy Payment Routing?

In short: the ROI is undeniable.

I like to think about routing based on three different key objectives. When properly deployed, payment routing can help merchants optimize all three of these points:

Are There Any Downsides or Other Considerations?

Building the necessary infrastructure for payment routing can be expensive. But, there are secure third-party options available to make it a much more manageable prospect.

The biggest challenge to executing a payment routing strategy is having dedicated engineering resources and ensuring control over customers’ card data and other personally identifiable information (PII) details.

Merchants will typically use a full-service PSP to store these types of details, or build the PCI-DSS compliant infrastructure using internal engineering resources. The cost of the second choice is high enough that most merchants opt to let a third-party store customer details. This can present some security concerns. However, some merchants are turning to tokenization service providers to provide a solution.

Tokenization service providers can store customer data in a vault rather than relying on a single PSP. Then, you receive a token that can be used to authorize a transaction or confirm payment details. With the token, you can run a decisioning engine and decide which PSP to use for a given transaction. Instructions can be sent to the vault so the details can be submitted accordingly.

You have all the control, with none of the risk or lock-in. In my view, this is a complete payment routing strategy.

FAQs

What is the routing number on a payment?

The routing number on a payment is a nine-digit code used to identify the financial institution responsible for processing the transaction. It is essential for tasks like direct deposits, wire transfers, and electronic payments, ensuring funds are routed to the correct bank.

What is smart payment routing?

Smart payment routing is the process of dynamically selecting the most efficient payment service provider (PSP) based on factors like cost, reliability, and success rate. This ensures transactions are processed optimally, improving payment efficiency and reducing operational costs.

What is a transaction route?

A transaction route refers to the path or sequence of steps a payment follows from the payer to the recipient through various financial institutions or payment service providers. It ensures the transaction is processed correctly, securely, and efficiently to reach its final destination.

What is considered a routed transaction?

A routed transaction is any payment that is directed through a specific path involving one or more intermediaries, such as financial institutions or payment processors, to reach its final destination. This process ensures the transaction is handled securely and efficiently across all required systems.

What are the different types of routing routes?

The different types of routing routes include direct routing and cascading routing. Direct routing involves sending transactions through a single, predefined path, while cascading routing dynamically reroutes transactions to backup providers if the initial attempt fails.