20 Simple Ways to Identify & Avoid PayPal Scam Emails

PayPal is a household name at this point. The platform has close to 350 million active users, making it an appealing choice for merchants to adopt as a payment option.

Those are some impressive user stats. But, it's important to note that the broad userbase will also, inevitably, catch the eye of scammers. As a result, PayPal email scams are on the rise.

Today, we take a look into one of the most prevalent scams affecting both cardholders and sellers on PayPal. We’ll explore how these scams work, a few red flags to watch out for, and the preventive measures you can take to stop them.

Recommended reading

- PayPal Chargeback Time Limits: 2025 Rules & Timelines

- PayPal Account Limitations? Here are 5 Ways to Respond.

- PayPal Refund Scams: How They Work & How to Stop Them

- PayPal Dispute Fees: How PayPal Chargeback Fees Work

- The Top 12 PayPal Scams to Watch for in 2025

- PayPal Purchase Protection: What is it & How Does it Work?

What is a PayPal Scam Email?

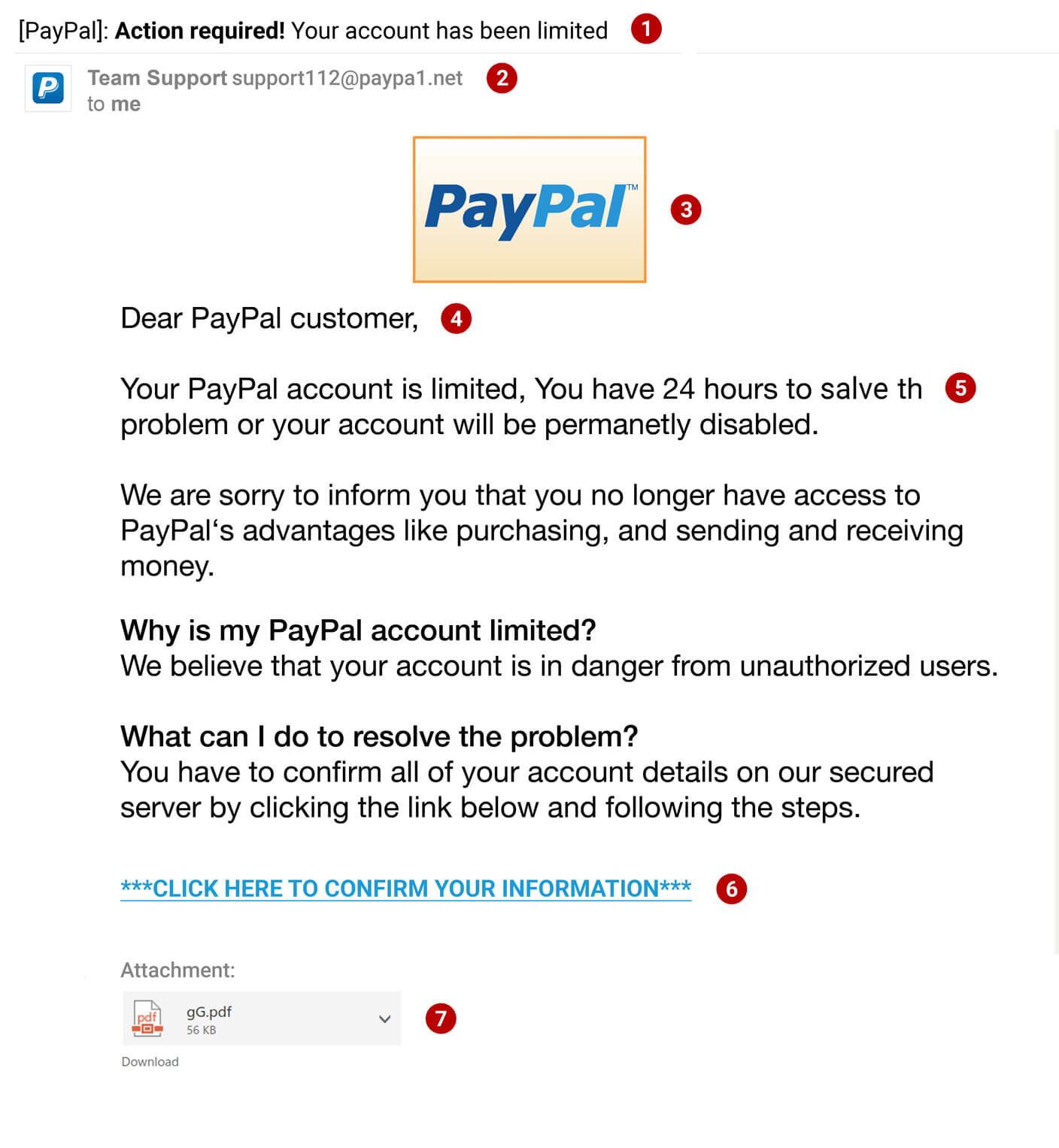

- PayPal Scam Email

A PayPal email scam is a type of phishing attack by which the attacker sends an email that appears to be from PayPal. The aim is to deceive recipients into revealing sensitive information, such as their PayPal username, password, or financial details.

[noun]/pā • pal • skəm • ē • māl/

PayPal email scams usually work by sending fraudulent emails that closely mimic official PayPal communications. Emails often appear to be sent from PayPal, and are presented as account alerts, or are warning you about unauthorized transactions, pending payments, or account verification issues. The scammer urges you to take immediate action due to a purported issue with your account.

- Urgent or alarming subject line designed to grab your attention immediately.

- Misspelled or disguised email address using lookalike characters or unusual domain names.

- Incorrect, outdated, or inconsistent company branding elements.

- Generic greeting such as “Dear Customer” instead of using your actual name.

- Noticeable spelling mistakes or awkward grammar within the message body.

- Suspicious links that lead to fraudulent or unexpected websites.

- Unexpected attachments that may contain malware or viruses.

Scam PayPal emails usually contain some kind of urgent call to action. The scammer presses you to click a link to “resolve the issue,” or else your account (and any money in the account) will be frozen or seized.

The scam email will urge the targeted individual to “resolve” account problems by clicking on a link. But, the link leads to a fake website that resembles PayPal's official site. If you try to log in, the scammer can capture your credentials and gain unauthorized access to your PayPal account. Once logged in, they can drain your PayPal balance or steal your identity. Stolen account details can also be sold on the dark web or used as part of more sophisticated attacks.

To protect yourself against PayPal email scams, always verify account issues by logging in directly through the official PayPal website or app. Be cautious with unsolicited communications, and never click links in suspicious emails.

Why Would Scammers Target Merchants?

PayPal scammers don’t just target consumers. They’re going after merchants, too, and for good reason.

The biggest draw for fraudsters is that merchants, in comparison to individuals, typically send more money with each transaction. They make more transactions in total, and hold larger PayPal balances. This makes businesses more attractive targets, since it’s easier to steal a lot of money from a single victim, as opposed to stealing a little from multiple victims.

Scammers can also launch more sophisticated scams at businesses. They can send bogus invoices, pose as potential customers or vendors, or even impersonate internal staff. These are all tactics that are less likely to work against individuals.

Examples of Common PayPal Phishing Email Tactics

Scammers use a combination of deception and urgency to trick victims into sending money or giving out their account details. Unfortunately, PayPal scams are difficult to spot, and even the most fraud-aware businesses and individuals can fall victim to scams.

Here are some common PayPal email scam tactics to look out for:

PayPal will never ask for sensitive information like your password, Social Security number, or financial information via email. Always scrutinize the sender's email address, check for poor grammar or spelling, and hover over any links to see where they actually lead before clicking.

Even with PayPal, your business may still be vulnerable to chargebacks.

Make sure you’re protected.

Request a Demo

10 “Red Flags” to Identify a PayPal Scam Email

Knowing PayPal email scams might target you is one thing. Knowing how to spot one when it pops up in your inbox is another thing entirely.

So, what should you be on the lookout for to prevent becoming a victim? Here's a deeper look into some of the common “red flags” to watch for:

How is PayPal Combating Email Scams?

PayPal has a direct interest in eliminating fraudulent PayPal emails wherever possible.

The platform’s fraud rate represents between 0.17% and 0.19% of revenue. That seems like a small number, until you consider the volume of money exchanged on the platform. PayPal fraud losses cost the company and its business and individual users an estimated $1 billion per year.

Currently, PayPal is working to address email scams through several initiatives. The company’s first line of defense is its line of in-house fraud detection tools. These help monitor and flag suspicious transactions through a combination of manual user reports, coupled with internal risk intelligence, data analytics, and machine learning tools that analyze over one billion transactions per month.

For merchants, PayPal packages these risk management tools into three suites:

| PayPal Risk Management Program | What transactions are covered? | How much does it cost? |

| PayPal Seller Protection | Eligible debit and credit card transactions | $0 |

| PayPal Fraud Protection Advanced | Eligible PayPal payments transactions, including Paypal, Venmo, and PayPal Pay Later purchases | $0 |

| PayPal Chargeback Protection | Eligible debit and credit card transactions | 0.4% per transaction |

PayPal also works collaboratively with trade associations, industry groups, international organizations, and law enforcement agencies to tackle and deter scams. For example, PayPal maintains public-private partnerships with nonprofits like Polaris, the World Economic Forum’s Global Coalition to Fight Financial Crime, and intergovernmental organizations like Financial Action Task Force (FATF), sharing threat data, risk insights, and best practices.

PayPal also partners with accreditation bodies like the Better Business Bureau’s Institute for Marketplace Trust, interest groups like the AARP, and regulatory agencies like the Federal Trade Commission (FTC) to protect businesses and consumers from scams.

What to Do if You Receive a PayPal Scam Email: Top 10 Tips

PayPal, like any other payment platform, is susceptible to being used by scammers. Also, it doesn’t matter whether you’re an everyday consumer who shops with PayPal or a merchant who takes PayPal payments; no one is immune to scams.

Knowing exactly what to do is crucial if you find a suspicious email lurking in your inbox. To that end, here are ten best practices you should follow if you receive a suspicious PayPal email:

#1 | Do Not Click or Download

First and foremost, refrain from clicking on any links or downloading attachments in the suspicious email. These could be phishing links designed to steal your personal information or malware that could infect your computer. If you accidentally click a link, do not enter any information on the website it directs you to.

#2 | Forward the Email

PayPal has a specialized email address for reporting email scams (spoof@paypal.com). Take the initiative to report the scam by forwarding the entire suspicious email to this address. PayPal's experts will analyze the email to improve their security measures.

#3 | Check Your Account

Access your PayPal account by manually typing "https://www.paypal.com" into your web browser's address bar. Do not use any links from the suspicious email to do this. Once logged in, review your recent activity to ensure there are no unauthorized transactions or alterations to your account settings.

#4 | Change Passwords

If there's even a slim chance you've compromised your login credentials, immediately change your PayPal password. Moreover, if you've used the same or similar passwords on other online accounts, change those as well to enhance your overall digital security.

#5 | Enable Two-Factor Authentication (2FA)

Enable two-factor authentication on your PayPal account. This requires you to confirm your identity in two ways, typically something you know (your password) and something you have (your phone). 2FA makes unauthorized access substantially more challenging for scammers.

#6 | Report to Authorities

In instances where you've incurred financial loss, or the scam attempt is particularly severe, consider filing a formal complaint with your local police department and other relevant agencies. This not only helps you, but also contributes to broader cybersecurity efforts.

#7 | Educate & Inform

If you're a merchant, educate your employees about these scams to create a more robust first line of defense. Consumers should also inform their circle of family and friends. Raising awareness can prevent others from falling prey to similar scams.

#8 | Monitor Your Accounts

Regular and thorough monitoring of your financial accounts (including PayPal) can help you catch any unauthorized activity early. If you notice anything out of the ordinary, report it to the financial institution immediately.

#9 | Contact Customer Support

If you're ever uncertain about an email's legitimacy, it's always a good idea to reach out to PayPal customer support directly for clarification. Authentic customer support will never mind verifying the details for you.

#10 | Use Security Software

Ensure you have reliable and updated security software installed on your computer. Regular scans for malware and other vulnerabilities can act as another layer of defense, identifying threats before they compromise your system.

Being proactive in your cybersecurity efforts is not just an option for consumers; it's a necessity in today's digital landscape. Arming yourself with this comprehensive guide allows you to protect your assets, reputation, and peace of mind.

Remember, you're not powerless against cybercriminals. Rather, you're taking back control and fortifying your defenses by understanding how to respond effectively to a suspicious PayPal email.

What to Do If You or Your Staff Fall for a Scam

The proliferation of highly targeted and virtually undetectable “spear phishing” attacks means that you can easily be the victim of a PayPal email scam, no matter how much fraud awareness training you or your staff have received.

Luckily, there are ways to contain the damage if you or your staff are targeted in a PayPal scam:

Change Passwords & Notify PayPal

Log out from all your devices and change your login credentials immediately after you realize you’ve been scammed. Doing so locks out the fraudster and prevents them from causing more harm to your business. Afterwards, scan your fraud detection systems for signs of additional or residual threats.

Notify PayPal

Next, contact PayPal customer service and report the incident, providing as many factual details as you can. This will alert PayPal to the attack and allow them to investigate the matter.

Notify Banks if Linked Accounts May be Compromised

If you linked your bank account to PayPal, contact your acquirer and inform them that the account may be compromised. Your bank may freeze your account, help you set up fraud and credit monitoring tools, or close your current account and open a new one on your behalf.

Consider Notifying the Authorities

If the loss is severe or pervasive, you can also file a police report with your local law enforcement agency, or report the scam to the FBI’s Internet Crime Complaint Center (IC3), as well as the US Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency (CISA).

Inform Any Other Parties Affected

Finally, if the fraudulent attack resulted in financial losses to (or involved the impersonation of) customers, vendors, or staff, notify those victims as well. Be transparent and objective; lay out as many details as you can, discuss your plan of action, and address how you will work to make them whole.

Prevention is the Best Medicine in Business

For business owners, PayPal is an excellent choice for peer-to-peer transactions and online sales. However, PayPal isn't without its flaws.

While promptly reporting PayPal email scams can help resolve a current incident, any reports from sellers tend to be reactions to past incidents. So, what best practices can merchants follow to prevent these scams from happening in the first place? Here are a few tips:

- Enroll in PayPal’s Seller Protection Program to secure compensation for any credit card fraud instances.

- Block or blacklist known fraudsters; they often return to exploit the same merchants.

- Before confirming purchases, thoroughly review shipping and account details and refine your fulfillment processes.

- Measure the success of your strategies using key performance indicators (KPIs).

- Stay vigilant for transactions where customers urgently request changes in shipping destinations.

- For high-value products, always ask for a signature upon delivery.

- Only send products to addresses verified by PayPal during the transaction.

- Be wary of any 'official' PayPal communications requesting personal data or login details.

Lastly, don’t forget that not all PayPal scams are perpetrated by anonymous cybercriminals. Some acts of fraud, like chargeback abuse, for example, are committed by your own customers. If your company is struggling with a high number of chargebacks each month, Chargebacks911 can help. Click below to learn more.

FAQs

Is there a PayPal email scam going on?

Yes. PayPal email scams are relatively common and usually aim to steal sensitive information like passwords or financial details. These fraudulent emails often impersonate PayPal in their design and language, asking you to log in via a link provided to "resolve an issue" or "verify your account." It's crucial to be vigilant and always double-check the sender's email and the website URL before taking any action.

How do I know if an email is really from PayPal?

To confirm an email is genuinely from PayPal, check that the sender's email address ends in “@paypal.com” and not variations like “@paypal.co” or “@secure-paypal.com.” Look for grammatical errors, poor formatting, or generic greetings, as these are often signs of a scam. For the utmost assurance, log into your PayPal account directly through your browser and check for any notifications or messages there rather than clicking on any links in the email.

How can you tell a fake email?

Fake PayPal emails often come from suspicious email addresses that don't end in “@paypal.com.” They may also contain poor grammar or misspellings. These emails usually urge quick action, such as claiming your account will be locked unless you verify your information immediately through a provided link. Always be cautious and verify any such claims by logging into your PayPal account directly through your web browser, not by clicking on links in the email.

What does a phishing email look like?

A PayPal phishing email typically impersonates the design and language of official PayPal communications but often has a sender email that doesn't end in “@paypal.com.” The email usually contains urgent or alarming messages, asking you to “verify your account” or “resolve a problem” by clicking on a provided link. These links lead to fake websites designed to capture your login credentials or other sensitive information.

What if I received a suspicious email from PayPal?

If you receive a suspicious email claiming to be from PayPal, do not click any links attached. Then, double-check the sender’s email address. If it’s not from PayPal, it could be a phishing email. Forward fraudulent emails to PayPal at phishing@paypal.com.

Why am I getting weird emails from PayPal?

If you’re getting weird emails from PayPal, it may not be from the company at all. Instead, scammers could be impersonating PayPal in an attempt to get you to reveal sensitive information.

What happens if I open an attachment from a phishing email?

If you open an attachment from a phishing email, you could risk downloading malware onto your device. These malicious programs could give scammers remote access to your device, allowing them to steal your personal or financial information.

Can I ignore a fake PayPal invoice?

Yes, you can ignore a fake PayPal invoice. However, the best course of action to take is reporting the email to phishing@paypal.com.