Explaining Mastercard Reason Code 4859 - No Show/Addendum/ATM Dispute

In simple terms, Mastercard Chargeback Reason Code 4859 — No Show/Addendum/ATM Dispute refers to situations where a customer claims the services purchased from a merchant were not fulfilled. The claim often, but not always, involves automated teller machines (ATMs).

When customers are unhappy with a transaction but cannot resolve the situation through the merchant, the cardholder may be able to force a reversal by filing a chargeback.

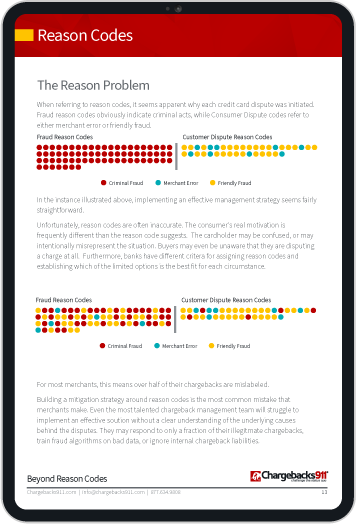

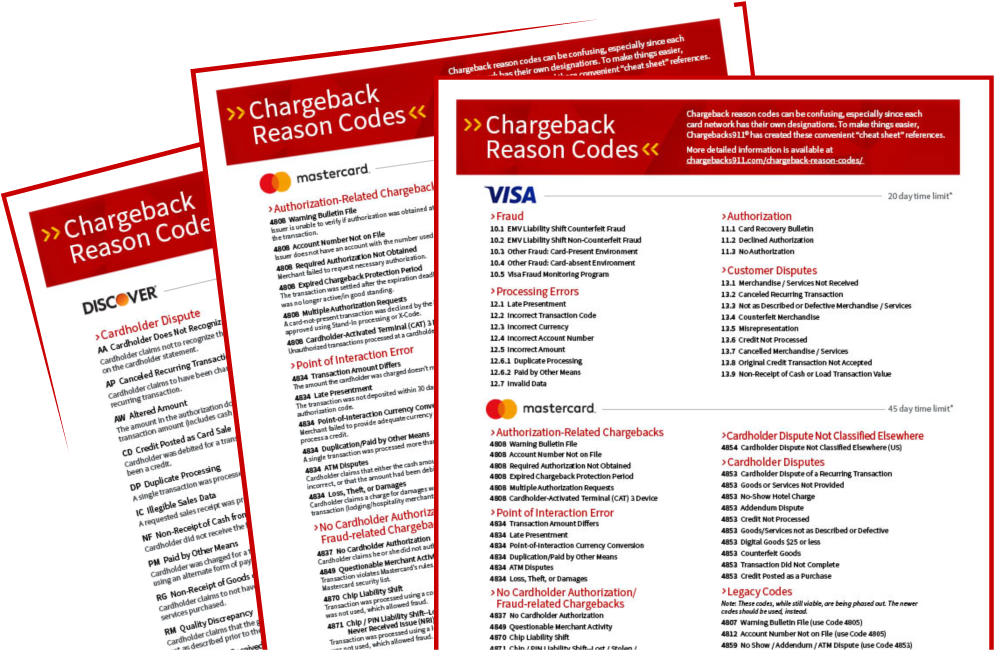

To simplify this process, the situations that may qualify for a chargeback are broken down into “reason codes.” Each card network has its own set of codes, and banks assign the appropriate one to each case, so all parties know the given reason for the chargeback.

While most of the same scenarios are covered, the designations can vary considerably. Understanding which code is which can be challenging, so we’ve created guides to help merchants know how best to fight or prevent the different chargeback types.

What Is a “No Show/Addendum/ATM Dispute” Chargeback?

A Mastercard chargeback under reason code 4859: No Show/Addendum/ATM Dispute covers situations in which a cardholder attempted to withdraw money from an automated teller machine, but was charged for more than they actually withdrew.

There are several scenarios where this might happen. For example, the cardholder may have been billed for the same transaction twice. They might have miscounted the withdrawn cash, or failed to retrieve the entire amount.

“No Show/Addendum/ATM Dispute” Chargebacks: Other Conditions

Particularly with older ATMs, this can also be caused by software glitches or the machine itself. A dishonest cardholder is also a possibility, though, which we will cover below.

Reason code 4859 was also used for “no-show” disputes and ones involving addendums. Chargebacks over no-show hotel charges come into play if the cardholder feels they were charged an undeserved no-show fee.

Addendum chargebacks occur in cases where the cardholder engaged in a valid transaction with the merchant, but was also charged for a subsequent transaction with that same merchant which happened without the cardholder’s consent.

Responding to Mastercard Reason Code 4859 Chargebacks

The fact that this reason code lumps together three different possible causes can make it extremely confusing. This is part of the reason Mastercard retired the code when it reshuffled its list of reason codes. Banks should not use code 4859, but some still do. For the time being, at least, chargebacks filed under 4859 are still considered valid.

Customers may use one of the above reasons to initiate a dispute. They may claim not to have received the right amount of cash, for example. They might be trying to avoid a legitimate no-show fee or get out of paying for a valid transaction.

If the merchant has documentation to show that the customer’s claim is invalid, they should challenge the chargeback through representment. For time limits and evidence requirements, consult our detailed article on Reason Code 4853 — No-Show Hotel Charge or Reason Code 4853 — Addendum Dispute.

Can Reason Code 4859 Chargebacks Be Prevented?

Reason Code 4859 was a favorite of friendly fraudsters, possibly because the claims are so easy to make. Unfortunately, there’s no sure way to identify friendly fraud before it happens. You won’t know until after the fact if a customer is deliberately trying to steal from you.

But there are still a fair number of No Show/Addendum/ATM Dispute chargebacks that are legitimate. This means they may be preventable by implementing best practices:

- If you own and operate an ATM, be sure it receives regular maintenance and software updates.

- Whenever possible, use new bills to stock your machine.

- Reconcile ATM-to-cash transactions as soon as possible. Double-check figures for accuracy. If logs reveal any type of error, notify the cardholder and remedy the error at once.

- If a customer reports an error, it’s usually best to shut down the machine until the hardware or software can be inspected by a professional.

- To avoid addendum disputes, never charge the customer’s card without express permission. Make sure the cardholder is well-informed if any type of recurring payment is needed.

- To avoid claims over no-shows, make sure all customers are aware of your policies ahead of time. Use a signature or online check box to show they have read and understand your policies.

- Carefully lay out any circumstances that may lead to charges for loss, theft, or damages that occur during the hotel stay.

Chargeback Prevention: A Wider View

While some 4859 chargebacks can be avoided, it’s generally more efficient to take a proactive stance with all aspects of chargeback management. A truly effective strategy must encompass prevention, but it is equally important to dispute cases of friendly fraud.

Chargebacks911® can help manage all aspects of every chargeback reason code, using proprietary technologies, experience-based expertise, and the industry’s only performance-based ROI guarantee. Contact us today for a free analysis to learn how much more you could save.