6 Chargeback Accounting Hacks to Avoid Disputes & Recover More Revenue

Chargebacks can be a bigger headache than you might realize at first glance.

You have to carefully examine the customer’s claim. Then, you have to gather all the compelling evidence you can to fight back, and submit your response as quickly as possible.

Even after the bank issues their decision… you still have all the bookkeeping to look forward to.

Chargeback accounting doesn't have to be the end of the world, though. You might just need a little help (and a lot of patience).

Recommended reading

- Chargeback Ratio: 8 Important Things to Know in 2025

- How to Handle Chargebacks: 4 Easy Steps to Follow in 2025

- What’s an “Acceptable” Chargeback Rate? Why Does it Matter?

- Chargeback Automation | Better Dispute Management

- Chargeback Reduction Plan: a Guide to Develop Your Strategy

- Chargeback Reports | Use Past Data to Stop Future Disputes

What is Chargeback Accounting?

- Chargeback Accounting

Chargeback accounting encompasses all the processes and practices used by a merchant to record and account for a payment dispute. This can also involve tracking and real-time reporting, as well as post-dispute practices like deploying dispute analytics and diagnostics.

[noun]/harj • bak • ə • koun • (t)iNG/

When accounting for chargebacks, you have to record and reconcile both chargebacks and chargeback reversals. These need to be factored in alongside the rest of your transactions and business costs.

As a result, chargeback accounting is not one, specific process. It touches on numerous moving parts within your business. It can have a profound impact on your finances and your operations.

Why Accurate Chargeback Accounting is Crucial

Proper chargeback accounting is critical. If not done properly, you’ll be unable to compile accurate chargeback reports, determine the ROI of fraud prevention or representment initiatives, or forecast the working capital impact of merchant account reserves.

Okay, so let’s say you’re already taking an active role in chargeback representment. You’re doing what you need to do to fight invalid chargebacks and recover your revenue. That’s good — but are you sure you’re getting the best bang for your buck?

Your chargeback management strategy is totally dependent on past data to diagnose chargeback sources, find recurring problems, and fine-tune your tactics. If you’re not tracking that data effectively, then you’re limiting your efforts.

It’s important to monitor dispute fees, along with other chargeback-related costs, to make sure you’re getting a good return on investment for your efforts.

Chargeback accounting is just like any other kind of bookkeeping. You can’t expect accurate reports if you don’t have accurate inputs.

Finally, accurate accounting for chargebacks is critical for long-term risk management. You need to have a clear picture of your current chargeback liabilities, how much you’re losing, and how much you stand to save by taking one action or another.

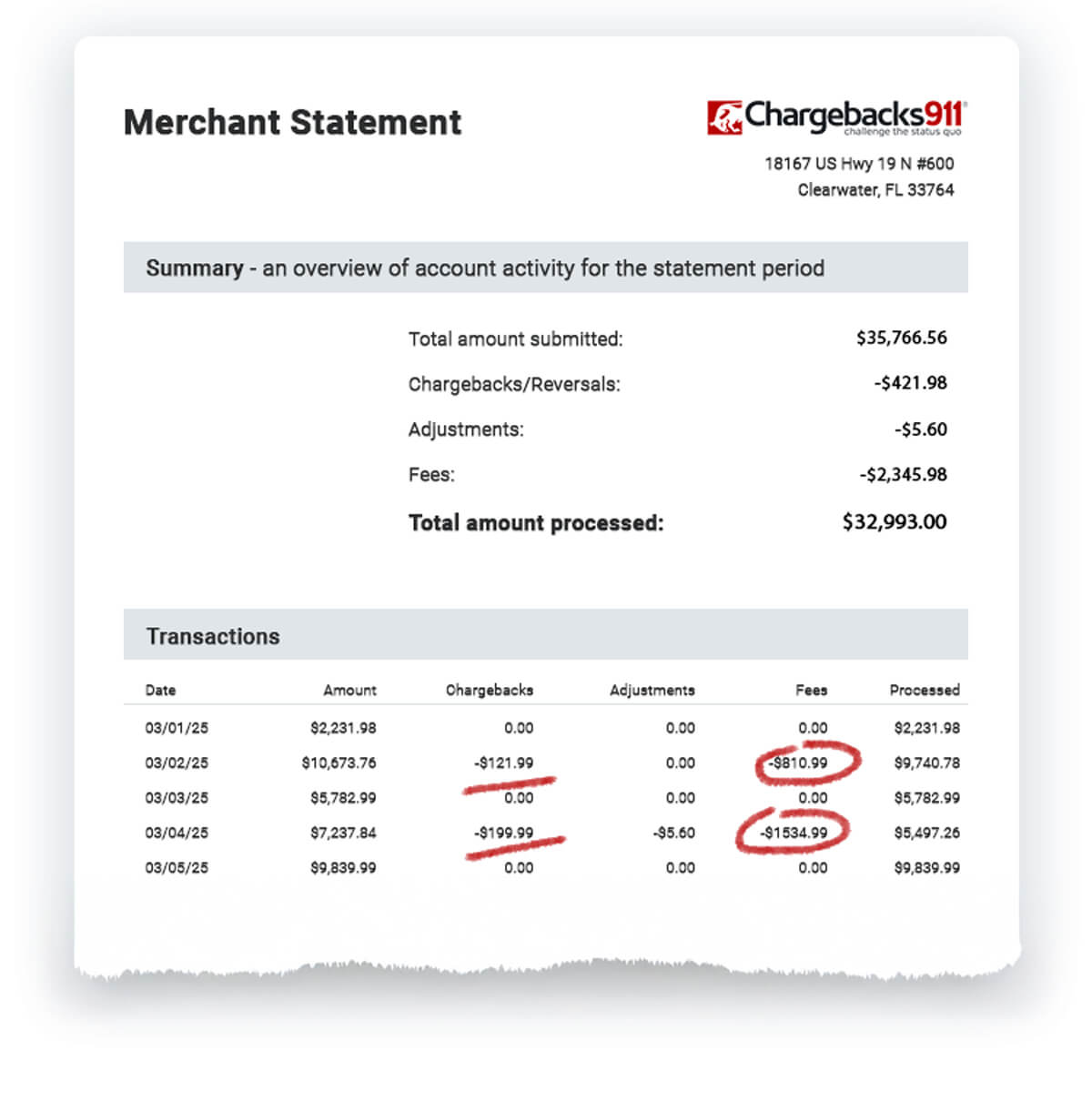

How are Chargebacks Accounted on Your Statement?

It’s best for chargebacks to be listed as their own line item, rather than lumped in with other expenses.

Major financial institutions are more likely to list chargebacks as separate line items on your monthly statement. Banks know it’s in their best interest to make this information clear and easy to find. This will make reconciling your statements easier, as well.

Some providers may lump chargebacks and expenses into a single transaction on your statement, though. That means it will fall on you or your accountants to correctly identify the particular chargebacks included in that amount.

This can cause other complications, too. For instance, you may have to contact the provider directly for information. It also makes it easier for individual transactions to fall through the cracks, leading to inaccurate ledgers.

Complications of Chargeback Accounting

Chargeback accounting is not straightforward. Chargebacks occur irregularly, the resolution process is long, and each chargeback generates several different expenses that must be tracked.

The most difficult aspect of chargeback accounting is the number of variables involved. You have to contend with the fact that:

3 Essentials for Better Chargeback Accounting

So, what’s the key to a solid chargeback accounting strategy? We can really break it down into three basic necessities:

#1 | Your Chargeback Management Dashboard

How can you manage chargebacks effectively when the information you need is scattered across a dozen different sources? Having one, centralized dashboard to track information like active chargeback cases, the real-time chargeback rate, and could be a lifesaver.

#2 | Your Analytics Tools

Tracking your chargeback rate sounds simple enough, but as we covered above, it can be a lot more complicated than it seems at first glance. Having the right software to analyze and parse chargeback information will be necessary to create relevant reports and develop actionable strategies for chargeback management.

#3 | Your Reporting

Chargeback software that delivers real-time reporting lets you get a picture of your current efforts as they’re being deployed. You can get up-to-the-minute information on chargebacks and disputes, distilling a massive, complex body of data down to give you a simple, accessible impression of how you’re performing.

Chargeback Accounting Hacks: 6 Tips to Eliminate Mistakes & Recover More Money

We recommend that you deduct as many chargeback-related expenses as possible, set up sub-accounts to distinguish chargeback fees from regular bank fees, and expense lost revenue as bad debts. You should also book fraudulent chargebacks as receivables, keep data sources updated, and get help from experts when needed.

As we’ve stated several times in this article, this can be a complex issue requiring foresight, sharp management skills, strict adherence to best practices, and excellent recordkeeping. If any of that sounds daunting, it should. It’s a lot of work.

Don’t worry, though: we’re here to help. We recommend the following practices and hacks to get the most out of your chargeback accounting:

#1 | Write Off Every Chargeback You Can

It’s possible to write off a chargeback with “uncollectible” status as part of the claim settlement process. In this case, the uncollectible amount can be written off for tax purposes, as no partial settlements are allowed.

Keep in mind, an amount is only considered “uncollectible” when there’s no possibility for recovery. For example, this works if the cardholder declares bankruptcy, a court expunges debts, or the individual in question is incarcerated or otherwise removed from the repayment obligation. Evidence for each instance must be included with any tax documentation.

#2 | Set Up Sub-Accounts When Necessary

Whether or not you win a dispute is a moot point regarding chargeback fees. These charges will be levied against you in either case. You should generally treat them as operating expenses (bank fees), unless your business receives a high volume of chargebacks. In that case, it may be easier to set up a separate sub-account for chargeback-related fees. That account could also be used for recording any expenses related to disputing the chargeback.

#3 | Label Chargeback Costs as Bad Debts

If you decide not to fight a chargeback, you should not post those funds under “Cost of Goods Sold.” After all, a chargeback is not a refund. Lumping dispute and chargeback losses alongside dispute losses will make your financial reporting inaccurate.

You should write off any chargebacks that you decline to fight as a “Bad Debt” expense. By doing this, you’re simply acknowledging that you’ve incurred a loss.

#4 | Mark Invalid Chargebacks as “Accounts Receivable”

Our data suggests that roughly 60% of all disputes are probably invalid. Invalid chargebacks resulting from first-party fraud are eligible for representment.

If you can prove a chargeback is invalid, and you intend to re-present it, you’ll want to log the initial transaction amount as “accounts receivable.” Preferably, you should do this in a separate account designated for funds owed to you and that will, eventually, move into your main account.

If you win, the transaction amount would simply be applied against your accounts receivable that were set up specifically for the chargeback. If you lose, however, the accounts receivable balance would need to be written off to Bad Debt Expense. Skipping this step would be a critical accounts receivable error.

#5 | Deploy Management Essentials

To keep fraud and chargeback ratios at a low percentage of their overall revenue, you have to respond to disputes quickly and fight first-party fraud whenever possible.

The key to either issue is data. The more up-to-date and comprehensive the data, the better. Many CRM dashboards track information across all merchant POS gateways, use analytics, and track both active and non-active chargeback cases. However, the system must track and report in real-time for this data to be effective in any fight against a chargeback.

#6 | Get Expert Help

A lot of merchants undertake chargeback management in-house. But, due to the complexities of chargeback accounting we outlined above, getting help from a professional management company that specializing in this area will generally produce the best results.

If you don’t have the funding and staff to handle the issue (and few businesses do), then you could stand to save time and money by outsourcing to a professional.

Invest in Prevention

Chargeback accounting isn’t impossible. However, accounting for chargebacks will lead to some serious headaches. The best way to reduce the stress associated with chargeback accounting is to prevent them from happening in the first place.

Unfortunately, no definitive combination of tactics will work for comprehensive prevention in every situation. That said, creating a customized plan that successfully addresses your situation is possible.

Chargebacks911® offers an unparalleled understanding of emerging threats coupled with real-world merchant experience. This enables us to create the most dynamic, most effective risk mitigation solutions in today’s market, all backed by the only performance-based ROI guarantee in the industry.

Chargeback accounting doesn’t have to mean regular monthly migraines. Contact Chargebacks911 today for a free ROI analysis. We’ll show you how much you stand to gain by optimizing this last essential layer of fraud management.

FAQs

How do chargebacks affect accounting?

The chargeback process is time-consuming, difficult to understand, skewed in favor of the cardholder, and expensive… but the complications don’t end there. Accurately accounting for chargebacks can be a nightmare. Still, it’s essential for identifying and tracking the true cost and impact of chargebacks on your business.

What does chargeback mean in accounting?

In accounting, a chargeback is the reversal of a payment previously made by a cardholder. Chargebacks typically happen because of cardholder or third-party fraud, defective or counterfeit goods, merchant billing errors, or declined requests for refunds, among other reasons.

Can you write off chargebacks as a business expense?

Yes, it’s possible to write off a chargeback as part of the claim settlement process. However, this only works for chargebacks with an “uncollectible” status. In this case, just the uncollectible amount can be written off, as no partial settlements are allowed.

How do you record a chargeback in accounting?

You first need to reduce the revenue in your sales account to reflect the chargeback value, then record the chargeback fees incurred as expenses. Maintain detailed records of all the chargebacks filed against you, regularly review records to identify chargeback patterns, and leverage the data obtained to prevent future chargebacks.

What kind of expense is a chargeback?

A chargeback and its associated fees are operating expenses. Most payment processors require merchants to pay chargeback fees, which usually range between $20–$100 per filed dispute, to cover the administrative cost of handling chargebacks.

How can you simplify chargeback accounting?

The software you use, the system you have in place, and the method by which you record your data will all affect the process. For best results, chargeback accounting should be managed in-house by businesses that have the funding and staff to delegate, or via a professional management company that specializes in this area.