Your Solid Response to Mobile Payments Fraud

Mobile devices can enable faster, more convenient, and more secure payments compared to traditional technologies. That doesn’t mean they’re invulnerable, though; we’re currently seeing a dramatic increase in cases of mobile payments fraud playing out across the online market.

Mobile Fraud Rising

Consumers will conduct roughly 85% of all online transactions via mobile channels by 2021. As the popularity of mobile devices grows and both customers and merchants become more familiar with the platform, concerns about risk in the mobile channel are dropping.

According to Kount’s Mobile Payments & Fraud 2017 report, merchants are less concerned about mobile payments fraud now than in 2015. Today, roughly 15% agree mobile is less risky than other channels, compared to 4.7% two years ago. In addition, survey respondents describing mobile as “somewhat riskier” or “far riskier” dropped from 43.9% to 25%.

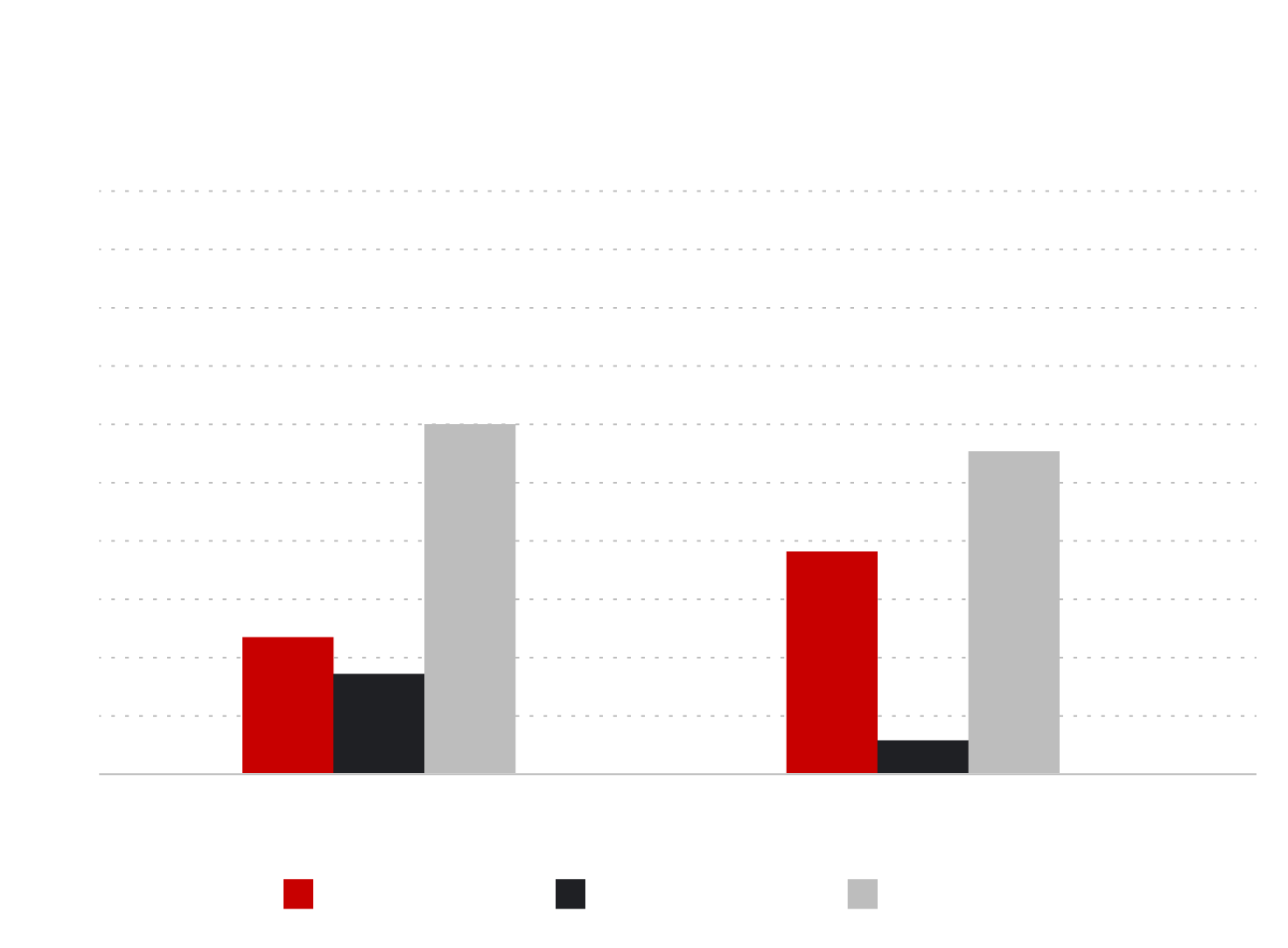

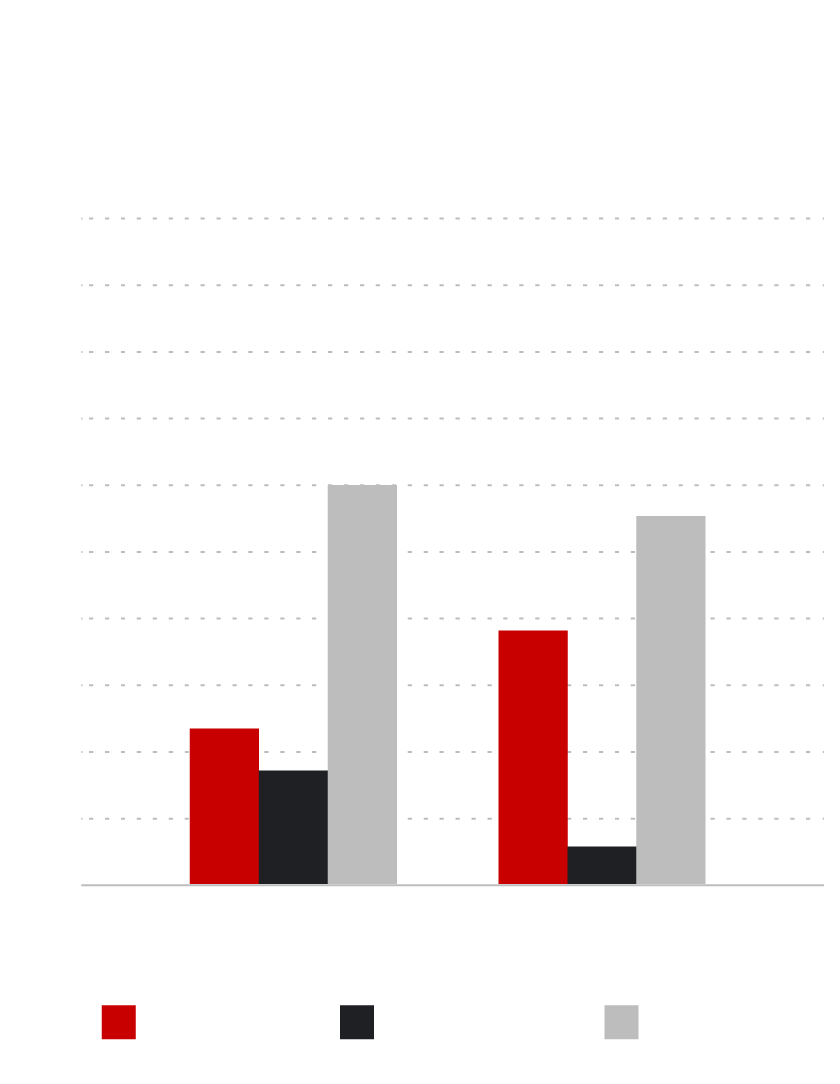

When asked if mobile fraud was increasing, merchants from each year believed fraud...

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0

2016

2017

Increased

Decreased

Same

When asked if mobile fraud was increasing, merchants from each year believed fraud...

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0

2016

2017

Increased

Decreased

Same

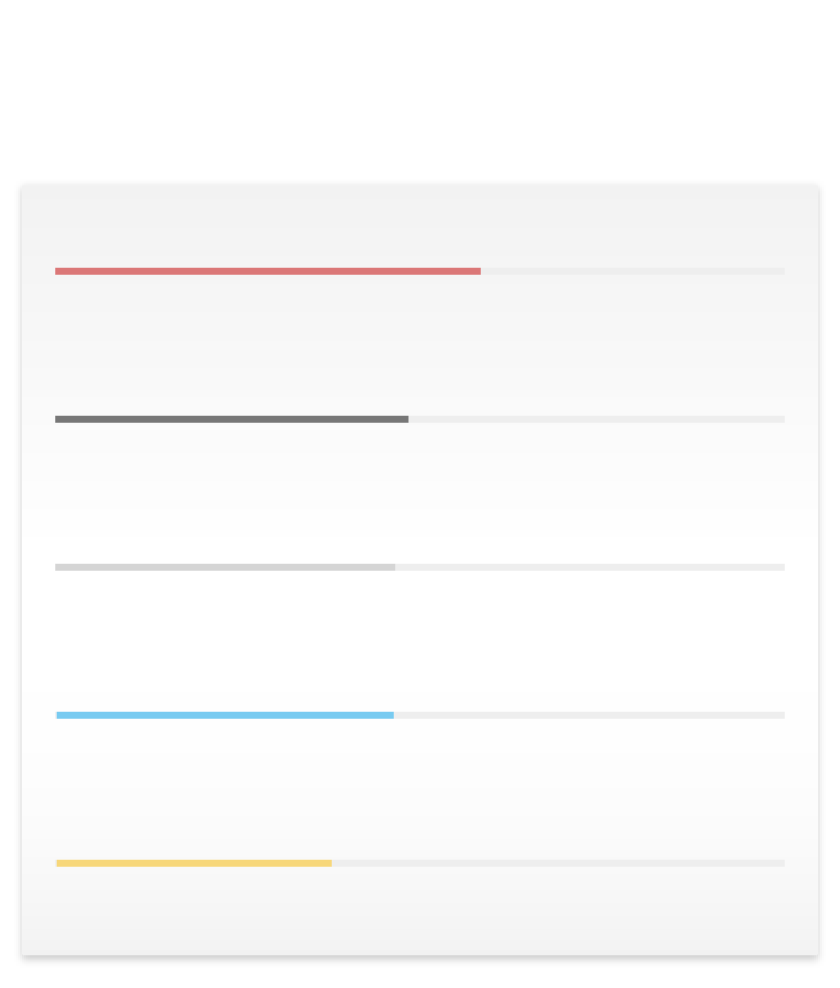

When asked if mobile fraud was increasing, merchants from each year believed fraud...

2016

23%

17%

60%

Increasing

Decreasing

Same

2017

39%

6%

55%

Increasing

Decreasing

Same

Oddly enough, the same sample group suggested that mobile fraud was on the rise. Comparing the survey impressions from 2016 and 2017 showed that far fewer merchants believed that fraud had decreased over the previous year.

How Are Merchants Responding to Fraud?

Maybe the reason merchants say mobile is less risky than before is because they’re taking it much more seriously. The Kount study revealed that merchants were adopting new mobile channels tools at a much faster rate than any previous year.

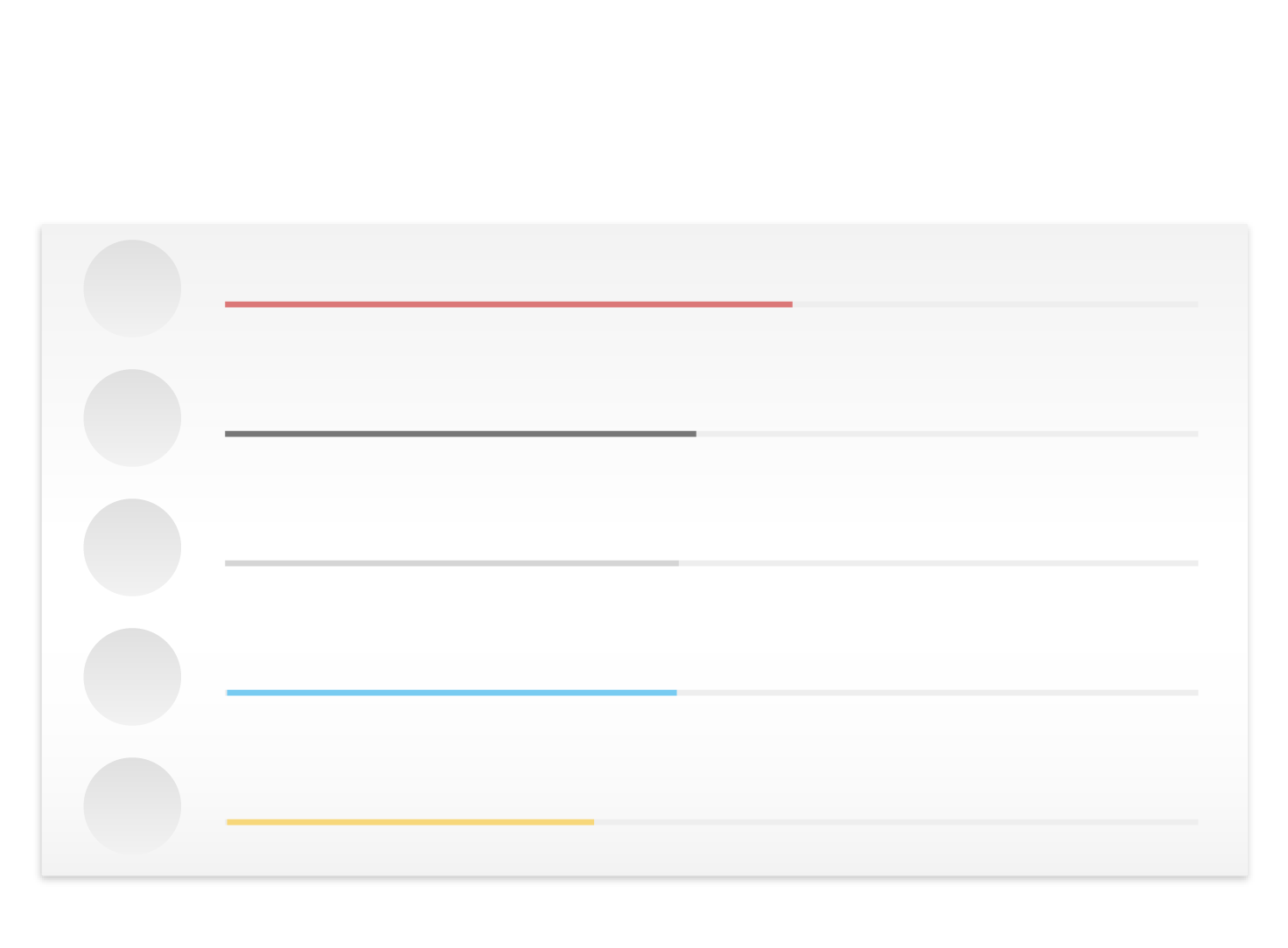

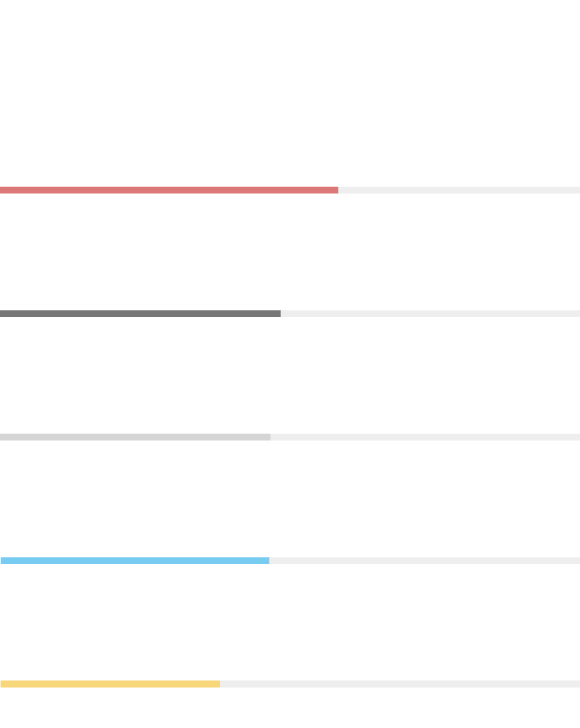

0% of merchants surveyed reported using 3-D Secure or CVV verification technologies in their mobile channels in 2016. However, nearly 20% said that they adopted the former in the 2017 report, while CVV usage skyrocketed to 58%. Other tools like geolocation, velocity checks, AVS, and machine learning all saw clear gains in use during the same period:

Top 5 Most-Used Mobile Fraud Prevention Tools in 2017

CVV

58.3%

1

Fraud Scoring

48.4%

2

Complete Fraud Platform

46.6%

3

AVS

46.2%

4

Device ID

5

37.7%

Top 5 Most-Used Mobile Fraud Prevention Tools in 2017

CVV

58.3%

Fraud Scoring

48.4%

Complete Fraud Platform

46.6%

AVS

46.2%

Device ID

37.7%

Top 5 Most-Used Mobile Fraud Prevention Tools in 2017

CVV

58.3%

Fraud Scoring

48.4%

Complete Fraud Platform

46.6%

AVS

46.2%

Device ID

37.7%

Top 3 Strategies to Prevent Mobile Payments Fraud

Mobile will dominate eCommerce in a few short years, but the shift to a more mobile-enabled environment doesn’t need to complicate matters.

Looking to identify essential tools for your arsenal? These three technologies will be more important than ever as the transition to mobile plays out. Make sure to adopt them into your strategy as soon as possible:

Device Authentication

You can use device authentication to explore whether a device has been used to complete a previous transaction. Looking at previous orders can give some insight into the purchase at hand. For example:

- Are items being delivered to the same address?

- Does the order involve the same buyer and payment information?

- Does the purchase seem suspicious in the context of previous purchases?

The data derived from previous transactions may not reflect the current transaction via the same device. In this case, the automated process could flag the transaction for manual review.

Geolocation

Like device authentication, employing geolocation give the merchant some insight into who is placing an order with their business. The technology uses satellite positioning to pinpoint the location of the device placing an order, which can be compared to the billing and shipping information to detect suspicious activity.

Geolocation can also help identify transactions placed from high-risk destinations. This allows you to flag those transactions, or if the destination is on your blacklist, to simply decline the sale outright.

2-Factor Authentication

Mobile wallet technology like Apple Pay and Samsung Pay involve 2-factor authentication. For a consumer to complete a purchase, they must first unlock the mobile device, then provide biometric authentication, such as a fingerprint or facial scan. While contactless payment fraud is still possible, it allows for much greater fraud protection than traditional eCommerce payments.

Sales involving Apple Pay and Samsung Pay are expected to reach $8 billion in 2018—a 1381% increase over the 2016 total. That’s still a very small portion of total spend, but consumer interest is expected to grow faster and faster as people get acclimated to the idea. Adopting this technology could both boost future sales and make those sales more secure.

No Single Solution is Foolproof

Even with these technologies at your disposal, you still won’t be able to intercept every instance of mobile fraud. Even worse, making your standards too strict will cause false positives to skyrocket.

Want to learn more about how to protect your business—and your bottom line—against mobile payments fraud? Click below to get started.