Fraud is On the Rise…But Not Where You Might Expect

Roughly 4 out of 5 payment cards in circulation in the US are now EMV chip-enabled, but fraud rates continue to spike. This is especially devastating for online merchants, who experience the real pressure of fraud in the post-EMV world full-force. What’s worse: the problem is much bigger than they realize.

Fraud Increases Across the Board

Cases of fraud are up across the board despite more attention and effort paid to fighting them than ever before. The August 2017 edition of the Card & Payments World US Country Report shows that between 2015 and 2016, the number of total fraud attacks in the US increased dramatically:

| Payment Method | Portion of Sales (Basis Point) | 2016 YoY Increase |

| Credit Card | 24.5 | 16% |

| Signature Debit | 16.9 | 17% |

| PIN Debit | 10.3 | 6% |

While counterfeit card fraud remained the most popular method of criminal attack, it was closely followed by card-not-present (CNP) fraud. Of course, CNP fraud explicitly targets eCommerce merchants, as all online transactions are card-not-present.

CNP attacks accounted for roughly 40% of all criminal fraud instances in the US in 2016. That is a shocking 33% increase in just one year. The rapid growth of CNP fraud tactics including account takeover fraud and clean fraud foreshadows a very disturbing trend for online merchants: as EMV cards become standard in the US market, counterfeit fraud becomes more and more difficult to pull-off. In response, CNP fraud will be the main method of attack for fraudsters, and eCommerce sellers will pay the price.

To Make Matters MUCH Worse…

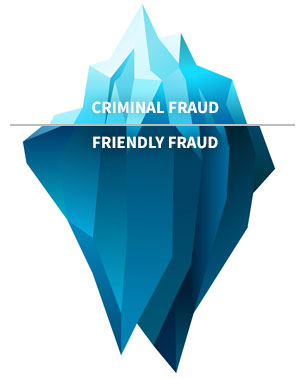

As scary as these figures are, they still undersell the threat that online merchants are facing.

These figures only reflect criminal fraud attacks. They do not address other, more difficult to track threat sources like friendly fraud—a seemingly valid transaction which later results in an unjustified chargeback.

Research suggests as much as 80% of all chargebacks result from friendly fraud. We also know that chargebacks will cost merchants upwards of $30 billion a year as soon as 2020, which equals the total now lost to criminal fraud.

If you’re an average merchant, you’re probably experiencing even greater fraud losses than you realize. That’s why you can’t afford to let friendly fraud go unanswered.

The Solution to Friendly Fraud

The problem: there’s no way to truly prevent friendly fraud. There are steps you can take to prevent some chargebacks, but friendly fraud flies under the radar disguised as a legitimate payment card dispute. That’s why the only way to address the problem is to fight friendly fraud through representment.

You’d assume recovering the revenue lost to disputes is the goal. Make no mistake: recovering revenue is important, but it’s only one of several benefits you will see with a successful representment strategy. An effective response to friendly fraud can:

- Separate fraudsters from legitimate customers.

- Eliminate fees and overhead from second chargebacks.

- Improve merchant-issuer relationships, preventing initial chargebacks.

- Encourage broader reform of chargeback regulations.

It’s not only possible to fight back against fraudulent chargebacks—it’s essential. We understood this fact years ago, and we’re ready with solutions for the rising threat of card-not-present fraud. Chargebacks911® offers the market’s only effective method to take on this challenge.

How Can I Fight Fraudulent Chargebacks?

Only through our unparalleled hybrid approach. We embrace a unique blend of strategies and employ two distinct tools to deliver the industry’s best results against friendly fraud:

Intelligent Source Detection®

Tactical Chargeback Representment

Our technologies are not reliant on error-prone automation. Unlike other service providers, we apply our own tireless research to develop human forensic expertise. It’s impossible to manage developing card-not-present threat sources without human insight, and there is genuine human intelligence behind each our solutions.

Ready to Take a Stand?

You don’t wait for the storm to hit before you start getting ready.

Fraudsters won’t give up—CNP fraud will increase. That’s why you need to put the power to stop it in your hands while you have the chance.

Click below to learn what you can do today to ensure your business has a tomorrow.