Which US State Suffers the Most Credit Card Fraud? We’ve Got the Answer.

The United States is an incredibly diverse country. The nation encompasses nearly every terrain and climate biome imaginable, including arid deserts, rugged mountains, expansive plains, balmy tropics, and even dense rain forests.

America’s diversity extends to every facet of life in the country. Unfortunately, that applies to credit card fraud as well. The amount of money that US consumers lose to credit card fraud every year varies widely from one state or territory to the next.

The FBI’s Internet Crime Complaint Center (IC3) recently published their data on US crime stats for 2020. This data tracks all incident of criminal fraud reported to the FBI during the year in question on a state-by-state basis. Keep in mind that these are just the incidents reported and tracked by the bureau; one-off fraud attempts that don’t warrant the FBI’s involvement won’t be included.

According to the report, some parts of the country experienced very little criminal activity involving credit cards. Guam, for instance, reported $0 in credit card fraud in 2020. In other states, however, the average fraud victim could expect to lose tens of thousands of dollars per incident.

We at Chargebacks911® decided to crunch the numbers and see which states saw the worst impacts of credit card fraud in 2020. Because of variations in state size and population, we’ve decided to gauge states by which had the highest average cost per fraud incident.

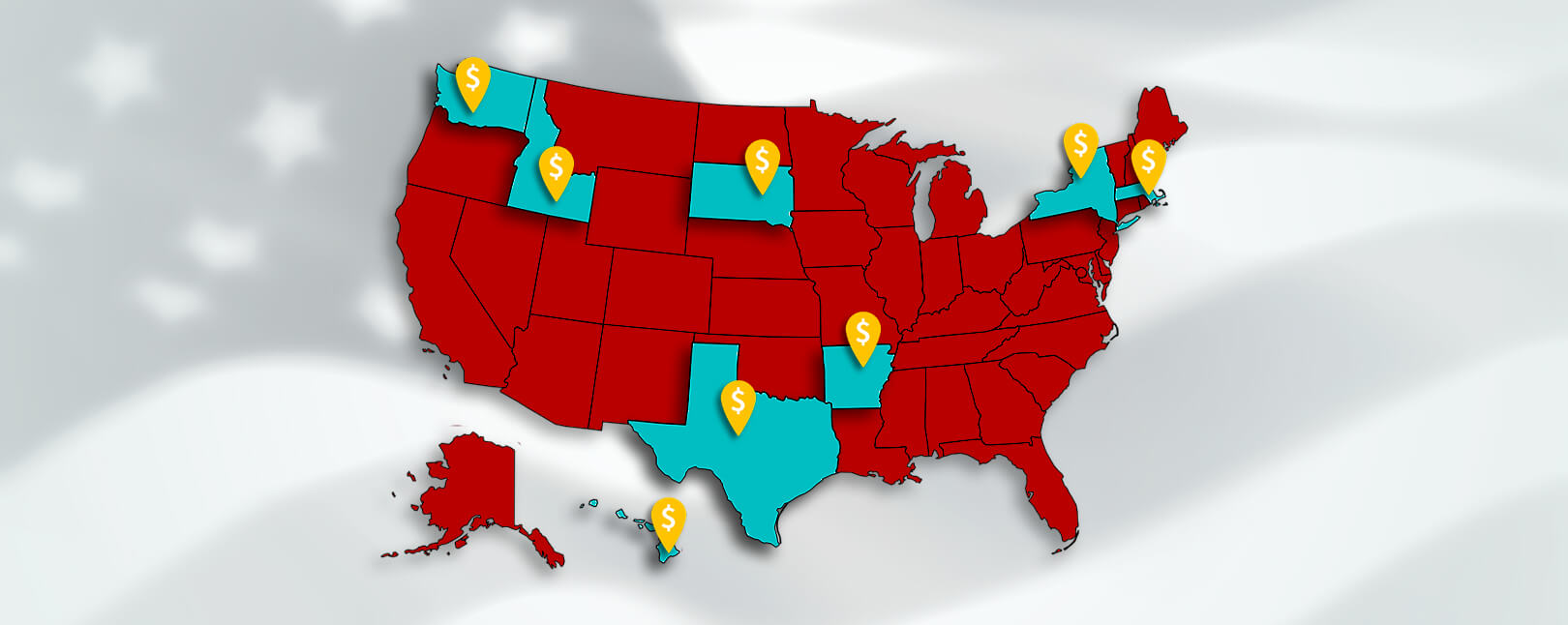

Below are the top 10 states with the worst credit card fraud in 2020…the results might surprise you.

Top 10 states with the worst credit card fraud in 2020

Idaho

Average fraud loss per victim: $8,172

Between skiing, rafting, fishing, and hiking, Idaho is a state that offers its residents plenty of opportunities to stay busy outdoors. However, it seems that the state’s fraudsters are keeping busy, too. Although the number of incidents reported in the state was relatively low at just 93, Idahoans collectively reported nearly three-quarters of a million dollars in credit card fraud losses to the FBI in 2020.

Massachusetts

Average fraud loss per victim: $8,515

From Plymouth Rock and Lexington Green to some of the very taverns in which the US founders planned the American Revolution, Massachusetts is a state rich in history and culture. According to the data, though, it’s also a state rich in fraud attacks. The average Bay Stater will lose a bit more than an average Idaho resident. Attacks are also much more common here, though, as it’s a more populous state.

South Dakota

Average fraud loss per victim: $8,776

South Dakota is home to some of the most awe-inspiring, untouched natural beauty the US has to offer, including the Black Hills and the Badlands, as well as Mount Rushmore. Although it’s one of the most sparsely-populated states in the country, South Dakota residents reported an above-average amount of money lost to fraud in 2020.

Arkansas

Average fraud loss per victim: $8,832

Since 2014, Arkansas has been considered the most affordable state in the US to call home. That might come in handy, considering that the average Arkansan who becomes a victim of credit card fraud can expect to be hit pretty heavily, compared to neighboring states. This was a surprise compared to other states that will come later on the list, considering that Arkansas sits low on the list of states ranked by median household income.

Washington

Average fraud loss per victim: $9,168

Washington’s nickname—the Evergreen State—is an appropriate one. Not only is the state home to many of America’s most verdant old-growth forests, but also some of America’s largest and wealthiest companies. Unfortunately, all that green also attracts bad actors. The average Washingtonian who falls victim to credit card fraud will lose well-above the national average according to FBI data.

Worried About Fraud Impacting Your Business?

Chargebacks911® has your back. Click below and learn more.

Vermont

Average fraud loss per victim: $10,472

Vermont is a state known for its pristine forests. It’s also known for being the home of much of America’s maple syrup production, as well as Ben & Jerry’s ice cream. All those sweet treats can’t cover up the sour taste left behind by more than $10,000 in losses for the average fraud victim in the state, though.

US Virgin Islands

Average fraud loss per victim: $12,403

Although not a state, the US Virgin Islands landed surprisingly high on this list for 2020. There were very few cases of credit card fraud reported to the FBI in the territory that year; however, each case was exceptionally high in dollar value. This probably owes to the fact that the Virgin Islands are a major tourist destination, but are also a popular choice for wealthy individuals looking for an island lifestyle. This may make the islands a target for fraudsters following those wealthy residents.

New York

Average fraud loss per victim: $14,411

As one of the richest and most populous states in the country, it’s not surprising to see New York turn up on this list. The state had an unusually high number of cases recorded in 2020, averaging more than 2.5 reports to the FBI per day. New Yorkers need to watch their backs, because it seems that criminals are looking to pull some high-dollar value credit card scams in the state.

Hawaii

Average fraud loss per victim: $23,842

Hawaii is a tropical paradise known for stunning beaches, thrilling surf, and unparalleled natural beauty. Much like the Virgin Islands, though, the proliferation of mainlanders with deep pockets coming to Hawaii might be connected to the high average cost of fraud per victim. The state’s volcanoes may not be explosive…but their credit card fraud and chargeback stats are.

Texas

Average fraud loss per victim: $30,955

What can we say? Everything’s bigger in Texas. The skies, the food…and the fraud losses. Not only did Texas top the list in terms of total credit card fraud losses per victim, but they also had the highest total dollar amount in fraud losses reported to the FBI of any state in 2020. Compare that to the largest state in the country by population, California, where fraud victims collectively lost less than half of what Texans did. Be sure to check your bank balance regularly if you call the Lone Star State “home.”