How to Handle Amex Reason Code C28 Chargebacks

American Express breaks down the acceptable causes for a customer to dispute a credit card transaction in their dispute guidelines. This is done for the sake of simplicity and standardization.

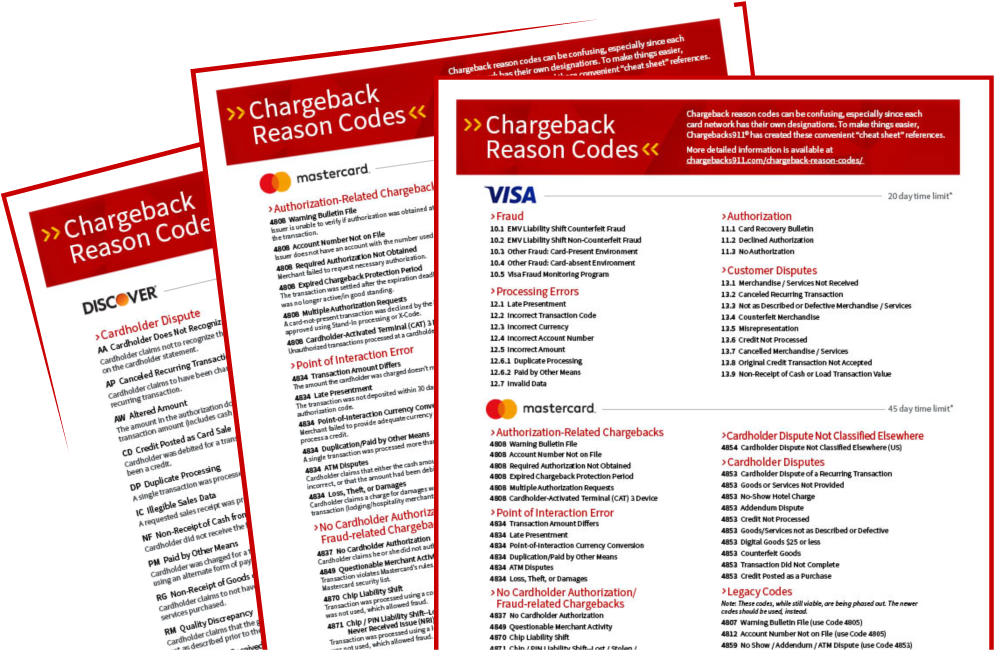

Each chargeback trigger has a designated “reason code.” Amex can then assign the appropriate code to each case to show the given reason for the chargeback.

Learn more about Amex reason codes

Today, we’re looking at one reason code in particular — C28 — and exploring the causes, timeframes, fees, and other specifics. We’ll also explore what you can do to prevent these chargebacks from happening.

Recommended reading

- What is Wire Fraud? How it Works | Examples | How to Avoid

- Issuer Declines: 7 Reasons They Happen & How to Fix Them

- What Happens if You File a False Chargeback Claim?

- Chargebacks911® CEO in New Feature for Grocery Trader Magazine

- Rapid Dispute Resolution: Avoiding Chargebacks With RDR

- Chargebacks911® CEO Featured by Tampa Free Press

What is American Express Reason Code C28?

American Express chargeback reason code C28 is “canceled recurring billing.” This reason code is used to explain that a customer attempted, but was unable to cancel a service.

When customers enrolls in any kind of service paid for using recurring billing, there’s an expectation that the customer will abide by the terms agreed to at signup. However, legislation like the Restore Online Shoppers’ Confidence Act, as well as the “Click To Cancel” rule adopted by the FTC back in 2023, also mandate that customers have an easy, straightforward way to cancel services.

If a customer believes they’ve conducted their due diligence in trying to cancel a recurring service, but the merchant has ignored their requests, they may be entitled to a reason code C28 chargeback.

What Caused This Dispute?

Amex chargeback reason code C28 is primarily issued if you failed to respond to a customer’s cancellation request in a timely manner. To demonstrate, this scenario can arise if:

- Order Not Yet Processed

A request for cancellation of weekly/monthly/annual recurring services was made but has not been processed in a timely manner. - Credit Not Received

Customer expected a credit or refund for a canceled recurring service, but the credit or refund was never issued. - Customer Billed Before Credit Arrived

You issued credit, but the customer was rebilled before the credit was posted to their statement. - Policy Misunderstanding

The buyer could not understand your merchant service terms, cancellation policy, refund policy, billing process, or automatic renewal terms. - Cancelation After Renewal

The cardholder canceled services after the renewal date, and so was billed for the renewed service. - Customer Attempted to Cancel Service

The customer attempted to contact you about cancellation of service, but was unable to reach you. - Delayed Cancellation of Service

The customer asked to cancel service, but the request was not fulfilled in a timely manner, resulting in the customer being charged for the renewed service. - Introductory Offers

The cardholder was billed for an introductory offer which they did not ultimately want.

How to Respond to Amex Reason Code C28 Chargebacks

So, what happens if you can prove that you did cancel a recurring service as the customer requested?

You have the right to challenge this chargeback through a process called representment. In essence, representment is your opportunity to present your case, showing that the transaction was legitimate and consistent with all the policies set by American Express. It’s your chance to provide hard evidence and tell your side of the story.

Time is of the essence when it comes to fighting chargebacks, though. You have just 20 days from American Express in which to submit your response. This window includes the notification period from your acquirer, plus any time spent reviewing your case. In practice, this often leaves you with five days or less to prepare all your evidence and submit your response. So, you have to act swiftly, efficiently, and decisively.

Acceptable Evidence for Amex Reason Code C28 Responses

You can re-represent these charges under the condition that you have compelling evidence.

For American Express reason code C28 chargebacks, you’ll need to provide a breakdown of your policies and procedures, showing how the cardholder failed to abide by them. Alternately, you can try to prove the cardholder plans to continue using your service (just not to pay for it), or proof that you’ve already provided a credit to the buyer to offset the charge disputed.

Examples of documentation you can submit include:

- A copy of your cancellation policy

- Copies of any emails or phone transcripts outlining conversations with the buyer

- Confirmation from the buyer that they’ve read and agreed to your terms of service

- Records of previous, undisputed charges from the same buyer

- Social evidence of the buyer using the good or service (photos, social media posts, etc.)

Alternatively, you might have already issued a credit to the buyer as a way of trying to avoid the dispute. In this case, you’ll need to offer proof that you already provided a credit to offset the amount charged.

The success of representment depends on the thoroughness and relevance of the evidence provided. Maintaining detailed records of transactions and communications with customers is vital to effectively counteract all chargebacks, including those under reason code C28.

Additional Evidence: Charges in Connection With an Introductory Offer

There are additional pieces of evidence you should provide if you receive a chargeback with American Express reason code C28 because your customer was billed for an introductory offer which they did not ultimately want. These include:

- Proof of a “simple and expeditious cancellation process,” which allows the cardholder to easily cancel before their initial charge.

- Proof that you obtained the cardholder’s express consent to the terms and conditions of the offer.

- Copy of a written confirmation that you sent the cardholder upon enrollment in the service.

- Copy of a written reminder notification sent to the cardholder, which allowed a reasonable amount of time for the cardholder to cancel service.

How to Prevent Amex Reason Code C28 Chargebacks

As the old adage goes, “an ounce of prevention is worth a pound of cure.”

You may never be able to stop chargebacks entirely. But, you can limit your exposure to risk and keep your chargeback ratio in good standing by adopting a few best practices. Generally speaking, you’ll want to:

Provide Prompt Cancellations

Act on a cancellation request immediately as soon as it lands in your inbox. Swiftly processing cancellations is the best way to prevent any potential disputes.Ensure Against Future Rebills

Make sure there are no future billings in the pipeline. These should all be canceled upon request.Submit Credits Immediately

When a customer cancels service, try to provide any credits due on the very same day. If it can't be done, acknowledge their request via email and give them a tentative date when you will issue the refund.Provide Confirmation

Even if the plan is to fulfill the cancellation request immediately, always send an automated confirmation email. This assures the buyer that you've received their request and are working towards completing it.Ensure Policies are Easy to Find & Understand

Your return and cancellation policies should be clearly visible on your website. Make them easy to find on all pages and as part of the registration or checkout process.Obtain Clear Consent

During checkout, make sure your cardholder actively agrees to your terms and conditions by clicking “accept.” This offers another opportunity for the buyer to familiarize themselves with the transaction terms and ensure they meet their expectations.Take a Wider View

You can dispute invalid chargebacks from Amex reason code C28. However, it’s much more efficient to take a proactive stance. The same is true of the other chargeback reason codes, as well. A truly effective chargeback management strategy must encompass prevention as well as disputing cases of friendly fraud.

Chargebacks911® can help your business manage all aspects of chargeback reason codes, with proprietary technologies and experience-based expertise. Contact us today for a free ROI analysis to learn how much more you could save.

FAQs

Does Amex investigate chargebacks?

Yes. American Express investigates chargebacks by reviewing the evidence provided by both the merchant and the cardholder to determine the legitimacy of the transaction and decide on the chargeback claim. This process ensures a fair resolution based on the documentation and arguments presented by both parties.

What is the reason code for a chargeback on American Express card?

An American Express chargeback reason code is a code that identifies the specific reason a cardholder or issuing bank has disputed a transaction, guiding the merchant on the nature of the dispute and what evidence may be required to contest it. Each code corresponds to a particular issue, such as unauthorized use, processing errors, or non-receipt of goods or services. Click here to see a full list of Amex reason codes.

Do police investigate chargebacks?

Police typically do not investigate chargebacks as they are considered a dispute between the merchant and the cardholder, handled through the card issuer's internal processes. However, if fraud is suspected as the cause of a chargeback, law enforcement may be involved in investigating the fraudulent activities.

How successful are Amex disputes?

The success of an American Express dispute depends on the merchant's ability to provide compelling evidence that the transaction was valid and in accordance with Amex policies. Success rates vary widely based on the nature of the dispute and the quality of the documentation provided by the merchant.

How does American Express investigate disputes?

American Express investigates disputes by reviewing documentation and evidence provided by both the cardholder and the merchant, such as transaction receipts, proof of delivery, or communication records, to determine the validity of the chargeback claim. This process aims to ensure a fair resolution based on the facts presented by both parties.