ABA Routing Number

The ABA routing number is a unique nine-digit identifier assigned to each US bank. This number is crucial for directing where payments should go within the payments ecosystem.

Created by the American Bankers Association in 1910, these numbers are primarily used in electronic transactions and fund transfers. They ensure that money from a transaction reaches its intended destination efficiently and accurately. By matching a routing number during a transaction, one financial institution can ensure they’re transferring funds to the correct receiving bank.

ABA routing numbers are used in transactions involving paper checks. They’re also used for wire transfers and direct deposits.

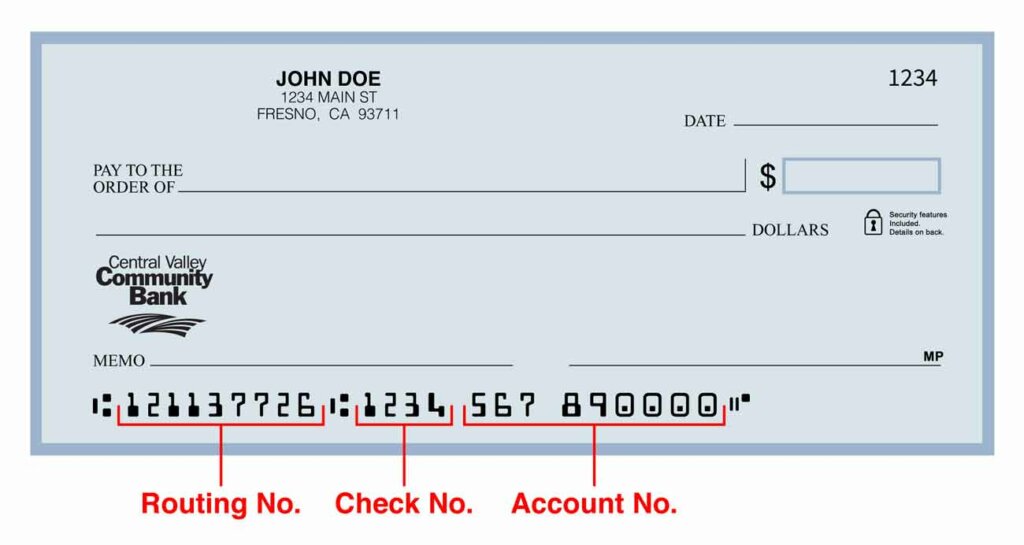

This number appears on the bottom left of checks:

Photo Credit: Central Valley Community Bank

ABA routing numbers have helped to simplify the entire payments process, making banking operations smoother and supporting the reliability of countless daily transactions.