ABA Routing Number

ABA numbers (also known as routing numbers) is the sequence of nine numeric characters found on the bottom of every check written in the US. This code enables banks to identify both the specific financial institution making the payment and where the money should ultimately wind up.

Developed by the American Bankers Association in 1910 as an aid for processing checks, ABA routing numbers are used in a wide range of banking transactions, like wire transfers, direct deposits, peer-to-peer payments transactions, phone payments, and more

While the codes are unique, larger institutions (Chase Bank, for example) may have more than one routing number, or even have distinct routing numbers for different types of transactions.

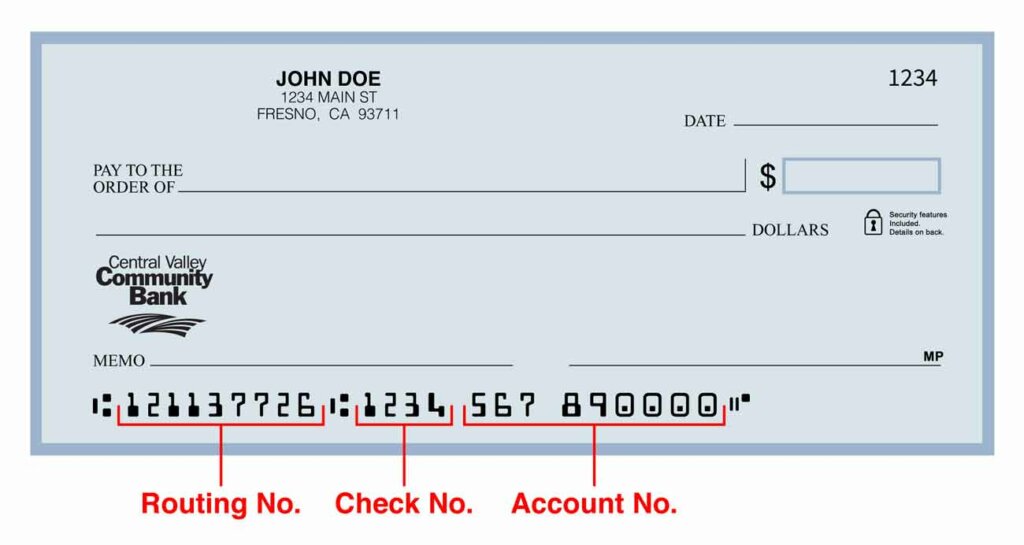

This number appears on the bottom left of checks:

Photo Credit: Central Valley Community Bank

ABA routing numbers have helped to simplify the entire payments process, making banking operations smoother and supporting the reliability of countless daily transactions.