Visa Reason Code 12.3: Incorrect Currency

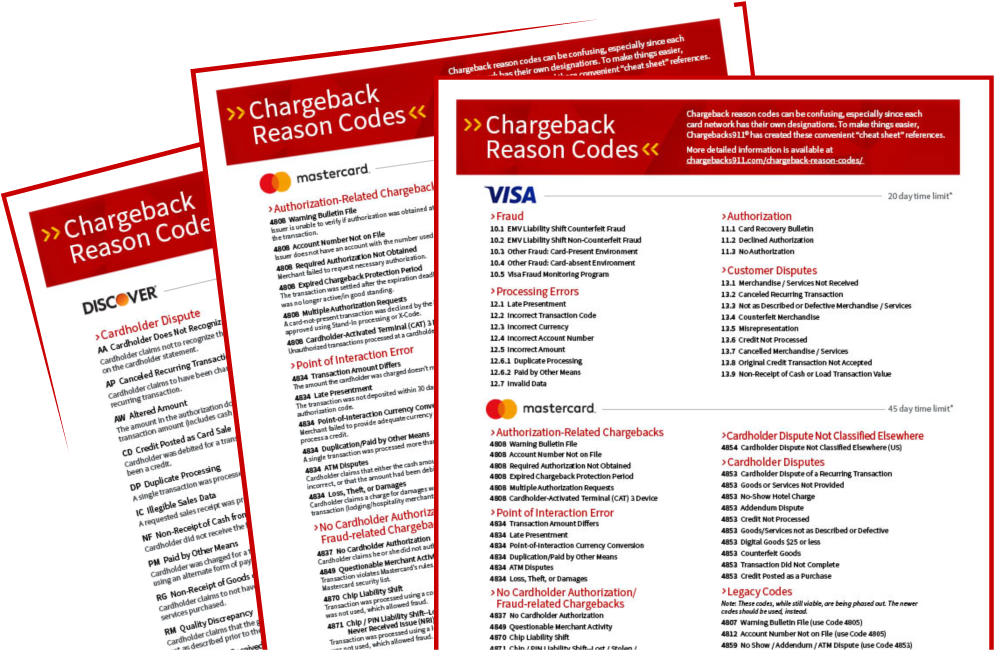

For the sake of simplicity and standardization, card networks like Visa have created a breakdown of the acceptable causes for a customer to dispute a credit card transaction by filing a chargeback. Each of these causes has a designated “reason code,” and banks assign the appropriate code to each case to show the given reason for the chargeback.

That sounds simple enough, but the reality is, the given reason for a chargeback may or may not be the true reason. Plus, each card network has its own set of reason codes—which, while nearly the same in function, nevertheless differ from one another. Keeping track of all these codes, along with the best ways to either fight or prevent each one, is challenging.

With that in mind, let’s take a look at Visa Reason Code 12.3: Incorrect Currency.

Reason Code 12.3 Chargebacks Are Completely Preventable.

We can show you how to protect yourself. Click to learn more.

What is Visa Reason Code 12.3?

Chargeback reason code 12.3 is an updated version of legacy reason code 76, which was phased out under the Visa Claims Resolution initiative. This code applies when a cardholder disputes a charge, and the merchant is informed by the processor that there is a problem with the transaction currency code.

Often, this is the result of one of the following scenarios:

- The merchant submitted a transaction with an incorrect currency reason code.

- The transaction currency doesn’t match the currency transmitted through Visa.

- The cardholder claims they didn’t know about, or didn’t agree to, the use of Dynamic Currency Conversion (DCC).

While this reason code is used in place of legacy code 76, it is narrower in scope. Reason code 76 also included transaction code errors that are now a separate category under reason code 12.2.

Merchant Errors, Rights, & Limitations

Chargebacks of any kind are nothing but trouble for merchants…yet many chargebacks are the direct result of preventable merchant missteps. It’s crucial for businesses to recognize the common merchant errors that might trigger a chargeback.

Incorrect currency chargebacks could have a simple explanation: the merchant used the wrong code for the type of currency used in the transaction.

It’s much more common, however, to receive a reason code 12.3 chargeback because the type of currency used in the transaction differed from the type of currency transmitted through Visa. An incorrect currency reason code chargeback could also be the result of misinformation. For example, the cardholder could be claiming that the merchant neglected to offer a choice of paying in the local currency (or that the merchant offered the choice, and the customer declined) through DCC.

The Dynamic Currency Conversion is a credit card processing service to help facilitate international transactions. Merchants who use DCC software give international customers the choice of paying in their local currency or the merchant’s currency. Merchants don’t have to offer DCC, but they must inform customers of its use and offer the chance for them to decline, or risk receiving incorrect currency chargeback.

As mentioned earlier, the given reason for a chargeback may be far different from the actual reason. While banks try to investigate all claims thoroughly before processing a dispute, the meteoric rise in chargeback cases has made this extremely difficult. In many cases, it’s more efficient to simply take the customer’s claim at face value.

Fortunately for merchants, there are at least some time limitations placed on chargebacks filed under Visa reason code 12.3. Now, no more than 120 calendar days can pass between the transaction processing date and the dispute processing date.

Reason Code 12.3 Chargebacks: Prevention & Response

Legitimate chargebacks based on Visa reason code 12.3 are the result of a simple mistake on the part of the merchant. In other words, they’re 100% preventable. All three triggers mentioned above could be thwarted by proper merchant procedures, and following best practices will also help the merchant dispute illegitimate claims.

All reason code 12.3 errors happen before the transaction is completed. That’s why it’s critical for merchants to implement regular, ongoing training to ensure that staff understand the correct way to code the transaction. It’s also important to always make sure the customer understands and agrees to currency conversion via DCC (if applicable).

Illegitimate incorrect currency chargebacks, oh the other hand, stem from customers making invalid claims. These friendly fraud chargebacks should always be disputed by the merchant.

While preventative measures can prevent valid chargebacks, illegitimate cases may slip through the cracks. Merchants who have evidence that refutes a cardholder’s claim should definitely challenge the chargeback through Visa’s dispute process. Here are some steps merchants can take to make the representment process more successful:

If… |

Then… |

| You believe the transaction was processed correctly… | ……provide documentation prove correct processing, such as evidence the cardholder actively chose DCC or a copy of the sales receipt. |

| The transaction was processed incorrectly… | …you must accept the dispute. |

| You have already processed a credit or reversal for the transaction… | …provide evidence of the credit or reversal,

including the amount and the date it was processed. |

| The cardholder no longer disputes the transaction… | …provide a signed letter or statement from the

cardholder which states they no longer dispute the transaction. |

Take a Wider View

Illegitimate late presentment chargebacks can be disputed. Valid chargebacks from Visa Reason Code 12.3, however, are the result of easily preventable merchant errors, so it’s much more efficient to take a proactive stance. In fact, the same thing could be said of other chargeback reason codes, too: a truly effective chargeback management strategy must encompass prevention as well as disputing cases of friendly fraud.

Chargebacks911® can help your business manage all aspects of chargeback reason codes, with proprietary technologies and experience-based expertise. Contact us today for a free ROI analysis to learn how much more you could save.