Will New Shopping Apps for Merchants Be a Smashing Success—Or a Huge Failure?

The payment industry is in a constant state of flux; new trends emerge daily. Some payment innovations have found more success than others. Will the new shopping apps for merchants be met with consumer approval, or are businesses failing to meet expectations?

Following the Leader: Starbucks

Since the company first launched their mobile app back in 2009, Starbucks Mobile Order & Pay has proven to be an overwhelming success. CEO Howard Schultz announced in July 2015 that 20% of Starbucks’ total sales were now coming in via the shopping app, nearly doubling the same figure just two years earlier.

The shopping app’s popularity owes to its seamless integration and ease of use, allowing customers to pay, order ahead and pickup in store, use coupon codes, and track and redeem My Starbucks Rewards® points. Naturally, other retailers took notice of Starbucks’ success.

Major retailers such as Target and Walmart, many of whom already have apps for online shopping and coupons, are now parlaying their existing apps into mobile wallet-style payment apps. The question is: will consumers go for it?

The Importance of Customer Loyalty

While speaking with Computerworld in December, market analyst Jordan McKee suggested that the new Walmart Pay shopping app lacks the customer loyalty aspect which made the Starbucks app such a success.

Besides the relatively new order online option, Starbucks built the success of their app on the strength of their preexisting rewards program. My Starbucks Rewards® offers customers a free drink for every 12 purchased, a free birthday drink, and special deals on food, coffee, and retail items.

Most experts would suggest that it was the manner in which customers were able to smoothly manage their account, reload, pay, and collect rewards using the app which was the true key to its success. They argue that in order for other retailers to capitalize on the same level of success which Starbucks saw, their app will have to offer the same sort of consumer incentives.

Do Consumers Want All These Apps?

A recent survey conducted by Retale found that 43% of consumer respondents have used a mobile payment option inside a retail store. This represents a 7% increase over the previous year alone.

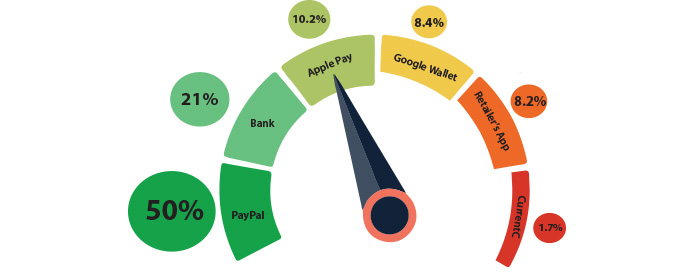

The same survey asked consumers which mobile payment app they would be most likely to use while shopping:

- PayPal: 50.5%

- Personal Bank (Bank of America, Chase, etc.): 21%

- Apple Pay: 10.2%

- Google Wallet: 8.4%

- Retailer’s App: 8.2%

- CurrentC: 1.7%

The conclusion which analysts drew from these results are as follows: convenience, brand familiarity, and trustworthiness were the primary concerns for consumers when deciding which method of payment to use.

[Tweet "Do you think it’s possible to create a shopping app that rivals the success of Starbucks?"]Consumers seemed most likely to prefer options which they already associated with online payments and banking, those which could be used at any NFC-enabled terminal. The more specialized shopping apps offered by individual retailers were the second-least popular option.

It's not too difficult to guess why consumers might trust PayPal and banks more than phone OS manufacturers and retailers.

In an environment in which stories about data leaks and hacks seem to come almost weekly, consumers are probably hesitant to trust their sensitive information to numerous different retailers. Not even Starbucks is immune in this instance, as we saw last year with the rash of hackers draining, reloading ,and re-draining Starbucks customers’ accounts. The incident proved to be a nightmare all-around, as consumers panicked and demanded chargebacks from the bank to try and recover their stolen funds.

Customer Convenience vs. Retailer Incentive

It seems that consumers are not very interested in using dedicated retailers’ mobile payment shopping apps unless there is some genuine, tangible incentive. At the same time, Retale suggests that the massive influence of the Apple brand will continue to propel Apple Pay to a greater share of the mobile payment market as the platform -- and mobile payments in general -- become more familiar.

Consumers are attracted to the “one app fits all” mobile wallets like PayPal and bank apps. At the same time, the Starbucks app offers mobile ordering and a brand loyalty program, while other mobile payment apps like Walmart Pay do not feature any comparable benefits.

In order to capture Starbucks’ momentum, retailers will need to incentivize shoppers to use their apps. Otherwise, as brands like PayPal and Apple gain increasing dominance, they will soon find it impossible to break into the mobile payment market.